This morning, automated communications management company Whispir (ASX: WSP) reported its FY 2020 results. Notably, there wasn’t a great deal that was new in the report, because the company gave plenty of salient disclosures when it reported Whispir’s quarterly cashflow report last month. Simply put, Whispir had ARR of $42.2m, up 29.4% for the year, but up only 4% quarter on quarter. This sluggish ARR growth is probably considered a negative but was already known, so it’s not clear why the Whispir share price fell down ~10% at market open.

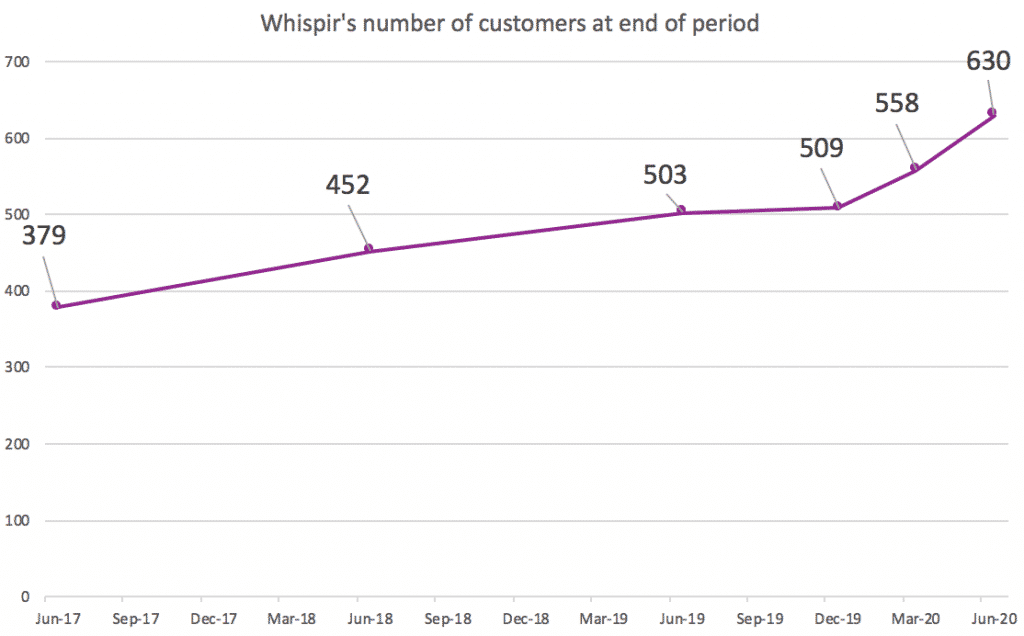

One new point that I haven’t really covered before is the fact that Whispir has notably sped up its customer acquisition as a result of fresh capital (from the IPO) and demand pull (from covid-19). You can see how profound the acceleration has been, below:

Now, Whispir has been a bit patchy with its disclosure of customer numbers, but based on past disclosures it looks like the increase in actual customer numbers has never been greater than in the most recent quarter. On the conference call the CEO Jeromy Wells said there were, “Higher numbers of new customer sales in Q1 than we’ve ever had before… it’s really positive but it’s not going to be linear… we anticipate winning more customers this year than we did last year.” The message here is that it will be hard to repeat the feat of adding 72 customers per quarter, but he still expects strong customer growth.

This is a good achievement because it’s not particularly easy to on-board customers. I have made my own enquiries and having used the platform as part of the sales process, I am certain that it takes days or weeks of work to onboard a larger customer, and assist their in house staff to understand the different use cases.

Whispir is not a “plug and play” solution because automated processes rely on someone building out the logical pathways. Automation is more useful when there is greater complexity, but even simple automation requires someone who understands the workflow to build the logic. A simple example of the logic would be instructing Whispir to send X message when event Y happens, if event P has happened prior, but send Z message when event Y happens, if event P has not happened prior.

As a result of this degree of complexity in using the platform, it is usual for clients to build out new use cases as time goes by, rather than all of a sudden. As a result, having a company as a client, and having one of their employees understanding how Whispir can help with different jobs to be done, often puts Whispir in a good position to increase revenue from that same customer over time.

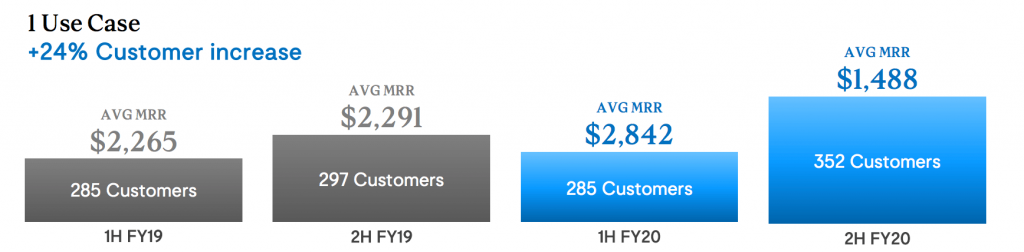

Ironically, the easiest way to see this land and expand trend is probably to look at the growth in customers using Whispir for only one use-case, against the total growth in customers.

As you can see above, the number of customers using Whispir for just one task was actually flat between June 2019 and June 2020, despite the fact that customer numbers actually grew by 25%. And in the most recent half, customers with one use case increased by 67, while the company added 121 customers in the same period. Given that most customers would initially have a single use case, this is strong evidence that use cases grow over time. This is a reasonably sustainable form of growth because the actual ways most organisations can use automated communications has a reasonably long way to go. This often makes sense for companies because an automated solution that informs and assists where problems or questions are predictable can reduce the need for staff answering phone calls.

Finally, the big bit of new news in today’s release is the guidance for FY 2021. The company says that it expects to report:

• Year-end ARR: $51.1m – $55.3m

• Revenue: $47.5m – $51.0m

• EBITDA: $(6.2m) – $(4.8m)

• R&D cash investment: $9.2m – $9.8m

Are Whispir Shares Attractive At The Current Share Price?

At the current Whispir share price of ~$4.30, the company has a market capitalisation of about $450m. Based on guidance for FY 2021, the company therefore trades on under 9x FY 2021 ARR. While that’s not mind-blowingly cheap, that does seem reasonable in the context of other companies listed on the ASX.

One thing to remember about Whispir is that it only has gross margins of around 60%, because it relies on other service providers to actually deliver some of its communications services. This puts it in the same boat as a company like Nearmap (ASX: NEA) which has margins in the same range at present. Even if Nearmap grows its annualised contract value at 25%, its ACV at the end of FY 2021 will be around $125m. With a market capitalisation of $1.4b, Nearmap trades at above 11x FY 2021 ACV.

To me, Whispir remains an attractive stock to hold. I have not quite decided whether I would buy, hold, or sell at current prices, but I reserve the right to take any action. On the one hand, I think the market may not appreciate that the strong customer growth may indicate accelerated revenue growth in the coming periods. But on the other hand, I’m mindful of my concerns raised in this musing from May. It is worth noting that I already took some profits at around $5 on July 23 this year, for a gain of 150% on the share price when I explained why Whispir was a large holding for me. Therefore, I may simply do nothing and continue to hold the stock in anticipation of future growth.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer.