While it understandably may have escaped attention, one little company that I own shares in is 4D Medical (ASX: 4DX), which is a very recently listed medical technology company without much revenue at all. This factors alone make it very risky compared to stocks I usually invest in, so why do I own it? I bought a tiny tiny parcel 4D Medical at a share price of $1.34:

To give a little backstory, the company listed in July this year, raising just over $50m at a 4D Medical share price of $0.73. Somehow, animal spirits have kept the share price soaring at almost twice that price, ever since listing. I suspect that part of the reason is that the CEO of Pro Medicus is on the advisory board, and many of the investors who have made a lot of money backing him before are keen to be part of another success story. This logic is far from iron-clad, but it’s not useless either. It’s hard to believe Mr Hupert would waste his time officially advising a business unless he found its offering intriguing.

It should be noted that I own a very small “research position” in the stock. This strategy sometimes works and it sometimes doesn’t, but if there’s a model I’d love to follow for my investment in 4DX it is Volpara. You see, I initially bought Volpara many years ago when it had very low revenues, having only just won its initial customers. Then, as it struggled to gain attention, I bought more shares, because I backed the people in charge to succeed. This doesn’t always work, but it did work in this instance, and the share price approximately 5-bagged from those lows I bought.

Now, history doesn’t repeat but sometimes it does rhyme. 4DX would have had to try to whip up some excitement for its IPO, but now comes the tough business of launching a new radiology product into a pandemic-ridden world. That won’t be easy.

But a quick look at the prospectus explains why someone might be optimistic about the business model. To quote:

4DMedical is a medical technology company focused on commercialising its patented respiratory imaging platform, XV Technology to enhance the capacity of physicians to diagnose and manage patients with respiratory diseases.

The global respiratory diagnostic market is estimated to be US$31 billion. Though this market is large and growing, in modern medical facilities, respiratory diagnostics are dominated by three procedures: the pulmonary function test (invented in the 1860s), the X-ray (invented in the 1890s) and the CT (invented in the 1970s).

4DMedical’s XV Technology has a number of advantages that can aid market adoption:

- XV Technology provides a non-invasive modality for physicians to understand regional lung motion and air flow, and to identify respiratory deficiencies earlier and more sensitively;

- XV Technology is designed to be fully compatible with existing hospital and clinic equipment so not requiring any capital expenditure; and

- XV Technology will be delivered through a cloud-based Software as a Services (SaaS) model, allowing 4DMedical to deliver its technology more quickly and at a lower cost base to existing procedures.

Of course, whether or not Sam Hupert is involved with a company my default assumption is that a company without much revenue will remain without much revenue. That is mostly what happens. And precious little evidence can prove that the story will be different for 4DX. In many ways, this is a story of hope.

But there is of course some good basis for that hope. Not much has been studied about 4D Medical’s technology, but what I can find seems very positive indeed. For example, the company itself has studied its technology in partnership with the Department of Radiation Oncology and Biomedical Sciences, Cedars‐Sinai Medical Center, and Department of Pediatrics Pulmonary Medicine, Johns Hopkins University School of Medicine. This study, which I stress was supported by 4D Medical, found that “XV analysis was more sensitive, revealing local variations in ventilation related to dysfunction, compensation, and changes over time not identifiable using PFT or CT. These results confirm that while XV technology is consistent with gold‐standard diagnostics, in many cases it offers superior sensitivity, providing considerable value to clinicians and researchers.”

In order for the company to succeed, they will need to build up more and more evidence to prove that their innovation is sufficiently better than the alternatives that hospitals (and therefore patients) should pay to use it. The process of convincing the medical establishment to use new technology is not easy, because clinicians typically want to be sure, and need to be convinced that the new technology brings real benefits. This process usually takes longer than impatient investors are willing to wait, and ultimately relies on convincing diverse parties that this technology can improve outcomes and reduce the cost of total care.

Therefore, the outcome I am looking for is for the market to lose interest in 4DX, and let the share price fall down to lower levels. In the last year 4DX burnt through over $8m in cash, and with just $1.23 million in reported sales of preclinical hardware and SaaS revenue during the year, it will rapidly obliterate its $50m cash kitty as it ramps up spending on sales, marketing and R&D.

As for the man in charge, CEO Andreas Fouras has previously said of the 4DX technology that “We feel very confident that this is an opportunity to build a multi-billion dollar business downstream.” His background is in engineering and academia, and he has reportedly “sold his house, packed up his partner and five children and moved to Los Angeles to pursue a multi-million dollar commercialisation deal, which could see his company, 4DX, revolutionise the field of respiratory diagnosis.”

None of this gives certainty about purpose, but this kind of behaviour is a notably different to some other tech CEOs I’ve sometimes observed who are serial players in “commercialising” a range of stock market “technology”, which inevitably completely lacks any customers whatsoever (and often any utility, really). These CEOs spend more time raising capital and pumping the stock to retail investors than actually coming up with inventions. Inevitably, they have little to do with science themselves.

Expert Founder CEOs

Generally speaking, I think med-tech businesses do better in the growth phase if they have CEOs who are actual doctors or medical researchers, such as Pro Medicus or Volpara.

I can’t be certain, but based on heuristics a technical CEO making his first foray into launching a company is not a bad thing (and only slightly less heartening than Volpara’s CEO, who had already successfully built a multimillion dollar company when he IPO’d Volpara). And after all, Fouras can explain why his technology is better in a single sentence. He says: “By imaging the breathing lungs, it is possible to see what is really important, which is how they work, not what they look like.” This is important, because they are not just trying to replicate human diagnostic abilities with machines (which is a typical faux “innovation” that rarely succeeds) but actually to improve diagnostic ability. And I think that is what this company is trying to do.

Only if you give better results to patients and payers alike will you stand a chance of changing behaviour quickly. 4DX seems to understand this, and argues that they can offer “competitive pricing below incumbent technologies”.

So What Now?

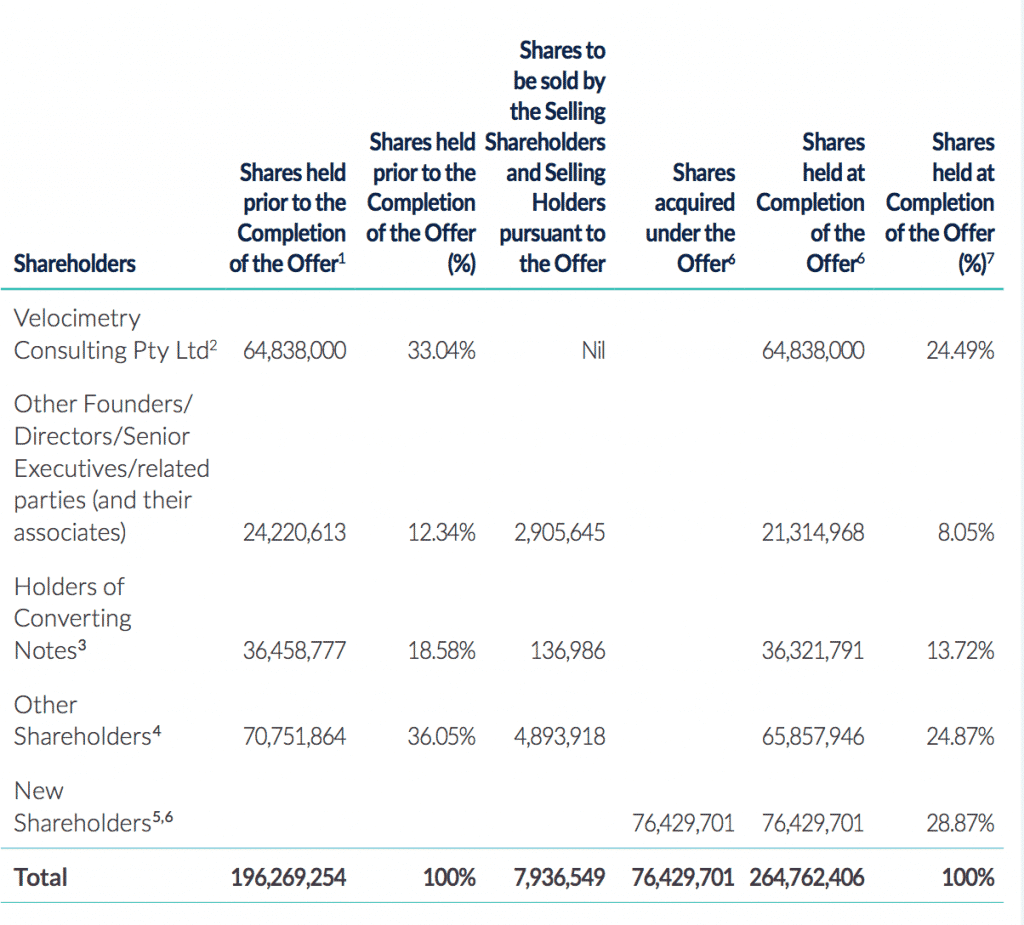

The set up I would like to see now is a falling share price. At $1.43 we are paying $377m for a company with barely any revenue at all. (Note in the table below that Velocimetry Consulting is the CEO’s company).

For me, in order to see more of an opportunity here, I’d want a lower price, or else significantly convincing sales growth. The problem with the current price is that it offers too much downside if sales are hard to accumulate. On the other hand, the reason the share price is so high is that it is quite possible to believe that this company could one day be a valuable software company worth more than $1b — if only it truly does add the kind of value it says it does.

The truth is we don’t know yet and this is therefore an extremely speculative investment, and not one I’d usually buy. But once in a while I do break my own rules and I’m happy to own a little 4DX just to increase the chances that if there ever is a really good chance to buy at a better risk versus reward, I take it.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer.

Disclosure: the author owns shares in 4D Medical, Volpara and Pro Medicus.