Urbanise.com Ltd (ASX: UBN) is an ASX micro-cap providing workflow software to strata and facilities managers. At the current Urbanise share price of $0.05 it has a market capitalisation of about $38 million and an enterprise value of under $34 million.

Unlike our prior Software Week companies, Damstra and PKS, Urbanise has a long listed history, inviting us to look back, as well as forward. To solve this dilemma, let’s start with the present. Today, Urbanise sells two kinds of software; facilities management software and strata management software.

Urbanise Strata Management Software

The strata software is used by large strata managers to increase efficiency by introducing a management solution to put invoicing, accounting, document management, trade service procurement and other strata manager needs all in one place. This platform hosts outsourced modules such as StrataVote for things like meeting management, where Urbanise doesn’t have the software itself.

With license revenue last quarter at about $1.1 million, this business has an important relationship with Australia’s largest strata management company, PICA. This 10 year deal was originally slated to contribute at least $21 million over 10 years, so at a glance PICA is probably almost half this business.

Having said that, I actually think it’s even more important than that, because PICA group has a broad suite of brands that pertain to strata management. That includes strata management companies such as Mason and Brophy Strata Management, New South Wales Strata Management, QBS Strata Management, Somerville Strata Management etc. As a result of its company structure, PICA Group is well placed to acquire other companies.

If we have a large player using Urbanise to drive efficiencies, it should be in a position to derive greater profits from the activity of strata managing. This is assisted by vertical integration into other services like legal services. If Urbanise is responsible for greater efficiencies, it makes sense for other strata management companies to use something similar, whether to drive down their own costs, or even to make themselves a more attractive acquisition. Consolidation in this sector could play into Urbanise’s hands, and create a success story that assists marketing down the line.

Urbanise Facilities Management Software

The facilities management side of the business is a little bit smaller, with licensing revenue of around $800,000 per quarter. It advertises “Complete visibility over all property and facility operations” and has modules that help manage a workforce, schedule contractors, check their insurance, and manage contact information alongside a history of communications and maintenance expenditures.

From what I can tell, facilities management doesn’t have so much reliance on a single big client, and is growing faster than the strata management business. On conference calls, the CEO has mentioned that IKEA is a client in Southeast Asia, and it seems possible there could be good things ahead for this business. Having said that, implementation fees for facilities management were a bit lower this quarter, so it may be that license fee growth will begin to moderate.

Urbanise.com Financial Analysis At A Glance

This post is not financial advice, and you should click here to read our detailed disclaimer.

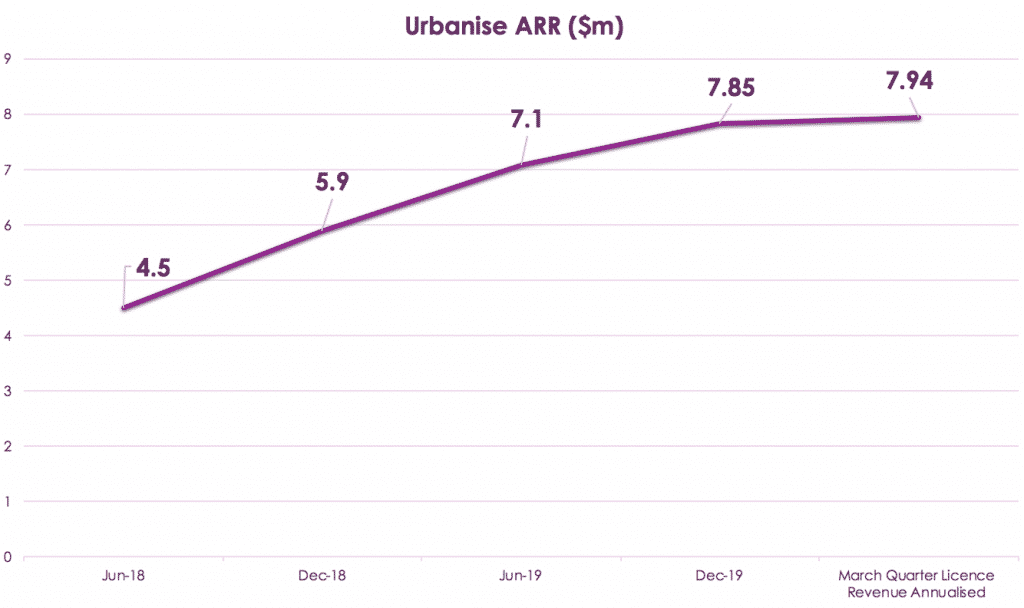

Looking at the business as a whole, we see annualised recurring software revenue of at least $7.94m, based on annualising the recurring licence fees booked in the last quarter. If it managed to add even a few small new implementations in the last quarter, and not lose anyone, then you could probably claim $8m annualised recurring revenue quite safely, though the company didn’t disclose in its last update.

In actual fact, it’s likely ARR is higher if the company began billing new customers towards the end of the period, and we should keep in mind annualising recent quarter receipts is a suboptimal proxy for end of month ARR. In any event, based on the current market cap and $8m in ARR, Urbanise.com is trading on less than 5 times recurring revenue, which is probably growing at around 15% to 20% per year.

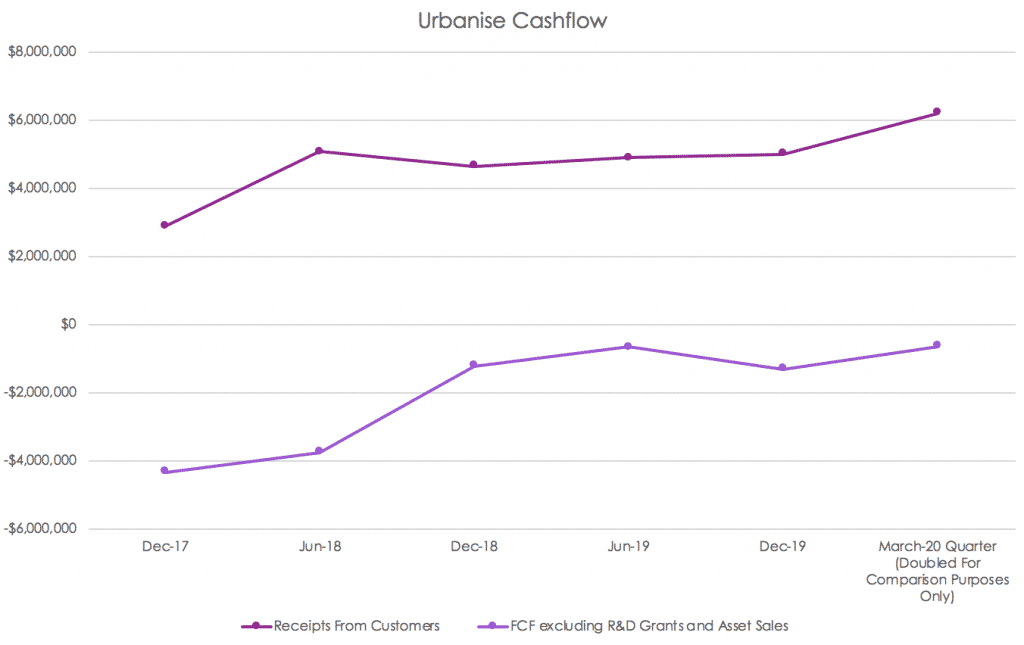

Obviously, as a sub-scale software company the bottom line is less impressive. Urbanise made a loss of $2.06 million in the last half, but booked positive operating cashflow in the most recent quarter. Current cash burn sits at less than $1.5 million per year. On its current trajectory, it would be reasonable to expect Urbanise could be profitable and cashflow positive in FY 2021. The chart below shows how the company is trying to operate in a way that doesn’t mean it constantly runs out of cash, while still managing to grind its revenue higher.

Normally, if a software company were trading at about 5 times annualised recurring revenue without burning cash outrageously quickly, shareholders would be calling for increased spending to juice growth. However, I don’t get that sense with Urbanise, and the board has installed a reformer CEO to get the ship in order and run it like a sustainable business. To understand why, we need to take a trip down memory lane.

The Troubled History of Urbanise.com (ASX: UBN)

None of this post is intended as advice, and it is certainly not a recommendation. But we do intend to share our understanding of the company, both the good bits, and the bad. If you’ve found something I haven’t then get in touch: I’d love to hear it.

What is clear to anyone, however, is that the Urbanise share price history tells us something went wrong after the IPO.

When Urbanise began publicity for its IPO in 2014, the AFR said “None of Urbanise’s current owners are expected to sell down. Private equity outfit Pierce Group Asia is the largest shareholder, with 40 per cent. Network communications systems company Cisco owns 12 per cent.”

And sure enough, they didn’t… Well, at least not until the escrow period was over.

Coincidentally, Urbanise managed to grow revenue strongly in the time after its listing, with booked revenue peaking in the second half of FY 2015. While revenue was roughly maintained over the FY 2016 financial year, the problem was that the company was essentially bringing sales forward by booking multi-year contracts in advance (or something similar), which ended up with huge sums of receivables.

Basically, the market had limited patience for revenues without the corresponding cash flow, and you can see how the share price basically cratered from the point the company reported its FY 2015 results.

Now, the reason the share price cratered was essentially because all the revenue was simply being booked as receivables. And as you might have guessed, plenty of those receivables never turned into cash.

Furthermore, in the intervening years the shareholders major shareholders who floated it, Pierce Group and Cisco, sold some of their shares (along with plenty of the original board members). Today, the register looks very different and is dominated by the kind of firms who look to buy distressed companies with potential.

The biggest holder is a private equity firm and without wanting to encroach on privacy, the register has major investors with a track-record of buying smashed micro-caps, and then selling for a great return years later. Suffice it to say, these kinds of investors can afford to make big mistakes and have a long time horizon, so that doesn’t mean Urbanise is guaranteed to succeed.

My biggest concern with any kind of Urbanise.com turnaround narrative has been the past history. But due to the large write down towards the end of the last CEO’s tenure, receivables are no longer at elevated levels. During 2017 until today the Urbanise (ASX: UBN) share price languished between about 3c and 6c. During that time, you’ve seen entities and people linked to current board members buying shares, including some linked to the original IPO at 50c!

For example, Tod McGrouther was appointed to the board in October 2018. His name is linked to another fellow called Keith Kerridge, who seems to be associated with Bannaby Investments, the second largest shareholder of the listed company.

According to the AFR, Keith Kerridge was the lead broker on the IPO of Urbanise. Meanwhile, Pierre Goosen is officially there to represent the largest shareholder Argosy Capital and David Cronin there to represent another large holder the Pierce Group (which invested well prior to IPO). Coincidentally, Cronin is also on the board of AVA risk group which also has Bannaby as a major shareholder.

I could go on, but the picture is simple; the company and share register is reasonably tightly held by a group of presumably friendly operatives who have installed a CEO who has brutally cut costs and while actually managing to eke out genuine cash flow growth. We’ll never know who was the driver of the misleading accounting and atrocious profligate spending in the early years of Urbanise’s listed life, but since the current posse have taken control of the company, and changed the CEO,the business has performed in an increasingly respectable manner. That’s not surprising given the people providing the capital are now represented in the boardroom.

A New Dawn For Urbanise.com Ltd (ASX: UBN)

Obviously, the new group of controlling shareholders accumulated their shares at relatively attractive prices, paying as little as 4 cents per share. That’s a 92% discount to the original IPO price, and not too long later shares trade 25% higher.

Now, Argosy and Bannaby can exercise almost complete control between them. Pierce might have had an influence, but it actually reduced its holding in FY 2019, although another entity related to Cronin called Pandon seemed to buy some of these shares. And while all this has been happening Australian Ethical Investments (ASX: AEF) has emerged on the share registry.

The receivables are in control, the CEO has bought a meaningful amount of shares on market and most importantly, the company has inched towards break-even. At this stage, it looks to me like the company is now being managed more with a “long-term owner mind-set” whereas previously it was not.

The new CEO of Urbanise Saurabh Jain has been heading up the company for about a year, and has spent most of his career working in the facilities management industry. As he tells it, he first encountered Urbanise as a customer and was so impressed by the software’s potential that he wanted to be part of it. His previous employer, Ventia, is counted as a customer and he joined Urbanise itself during 2017, during the changing of the guard. Saurabh came out on top, but only now will we see if he has what it takes to generate significant value for shareholders. He owns about $130,000 worth of shares at current prices, and more than that in performance rights, so he would enjoy meaningful upside if he can help improve the value of the business.

Urbanise should benefit the economics of the strata and facilities management industries. Essentially, these are fairly fragmented industries that have relatively low levels of automation. For example, PICA had inhouse IT systems before it moved to Urbanise, and the transition to Urbanise is taking years. Clearly, Urbanise software is not particularly modular and easy to implement that growth will be top notch in the near term. On the other hand, it’s reasonable to expect that once clients transition to the software, they will stick with it for a long duration.

On top of that, implementations in facilities management appear to be possible with just one or two employees in the country, so absent marketing costs growth will not be too expensive to come by. My biggest concern with Urbanise is that its difficult growth is testament to a very competitive environment. My biggest hope for Urbanise is that it is finally reaching a scale where it will be able to sustainably invest in growing the business, without needing endless dilution.

Ultimately, the key for Urbanise will be whether it can empower its partners to succeed, and thus build its brand through their success. That is far from certain, but at current prices the risk versus reward looks favourable to my mind. Even if growth is a bit of a slog, I could see the share price significantly higher in 5 years time. I do think it’s worth watching, and I take some comfort from its recent statement that Covid-19 has, to date, had “no material impact to date on the demand for Urbanise’s cloud based software”.

Disclosure: I hold shares in Urbanise.com and will not sell for at least 2 days after the publication of this article.

If you haven’t already tried Sharesight, it saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade, you’ll get at least 2 months free and we’ll get a small contribution to help keep the lights on.