Whispir (ASX: WSP) is a small cap software company on the ASX which provides software that automates electronic communications such as SMS and emails. Whispir is burning lots of cash, and this article will explain why I think there will be another Whispir capital raising.

However, Whispir says it is “confident the business remains sufficiently funded to reach its stated objective of positive EBITDA (excluding share-based payments) during the second half of this financial year (FY23).”

I sold my Whispir shares over a year ago, but still follow the company for the sake of my investing education. Suffice it to say Whispir has performed worse — both in terms of growth and in terms of cost control — than I thought it would, even when I sold.

Can Whispir Reach Profitability Without Raising Capital?

Now, there are multiple ways a company can boost EBITDA, such as capitalising more of its software development. I have no idea when Whispir will achieve positive EBITDA (excluding share-base payments) but I don’t believe Whispir will actually reach cashfow positive or genuine profitability, before it runs out of cash.

Let’s look at the facts.

- Whispir had about $18 million in cash and term deposits at the end of September 2022.

- Whispir burned through about $9 million in cash in the quarter to September 2022.

- Annualised recurring revenue (ARR) at the end of the Quarter is $62.0 million, down from $65.4 million three months prior.

Based on the ARR trajectory, there’s no reason to believe that revenue will grow strongly over the next few quarters. Even if it does, that growth will be accompanies by a significant growth in “product manufacturing and operating costs”, since Whispir still needs to pay telecommunications providers for SMS to be sent.

In the last quarter, receipts less product manufacturing and operating costs were about $6.5 million, and staff costs were over $10.7 million. Now, let’s imagine that in the next few quarters staff costs reduce by a full 50%, to $5.35 million per quarter. And at the same time, let’s say that receipts receipts less product manufacturing and operating costs grew strongly to $9 million.

Even in that goldilocks scenario, Whispir would still be burning cash due to roughly $1m in marketing spend per quarter, alongside over $2m in administrative costs, and almost $2m in capitalised software development. So even if it fired a huge number of employees, and returned to revenue growth, Whispir would still be burning cash, albeit at a much lower rate. This highlights the immense task required to bring the company to a sustainable free cash flow position.

When Will Whispir Raise Capital?

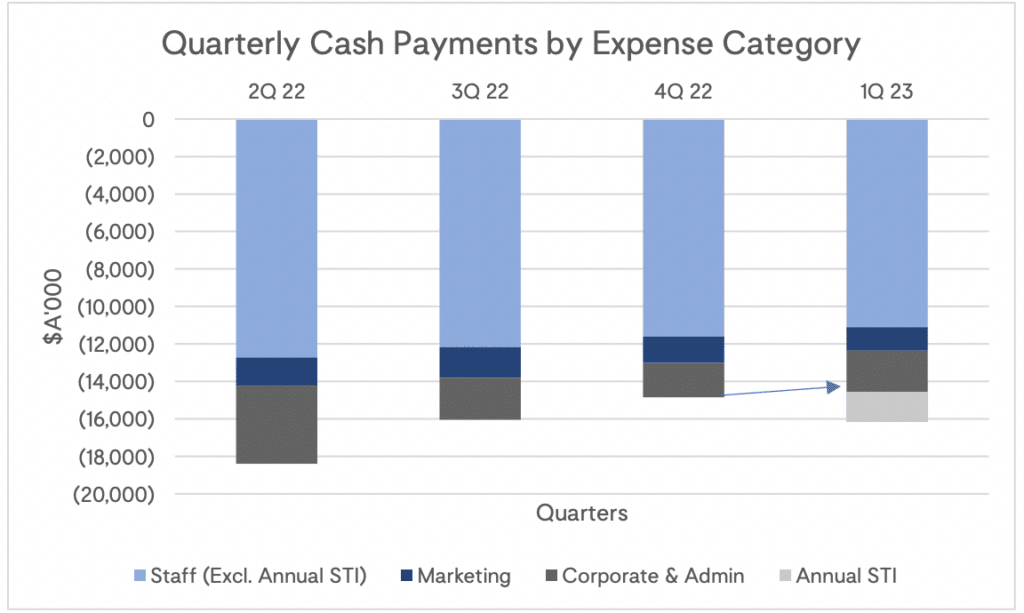

A more likely scenario, but still an optimistic one, from my point of view, is that receipts come in at around $15m to $18m per quarter for the next few quarters, which will amount to perhaps $7 million to $9 million in receipts after product manufacturing and operating costs. Expenses will certainly drop, because this Q1 result had the burden of the annual short term incentive payments, as you can see in the chart below from Whispir’s quarterly report.

You can see that even excluding the Annual STI payment, Whispir has only cut cash expenses by about $4m in four quarters, an average of $1m per quarter. If we double that expense reduction rate, then the next three quarters would see these cash expenses (excluding product operating costs) come in at ~$12 million, ~$10 million, ~$8 million. Add in around $2m per quarter in capitalised software development, and you get ~$14 million, ~$12 million, ~$10 million.

Against this, at best, I’m guessing Whispir will have around $8m per quarter in receipts, on average (after those pesky product operating costs). So over three quarters, we’d have $24 million in receipts (after product operating costs) and a whopping $36 million in expenses, leading to a deficit of about $12 million.

In that scneario, after three quarters, Whispir’s cash balance would be reduced from ~$18 million to ~$6 million. Their most recent quarter would still have seen cash burn of over $2 million.

You see, the above analysis ignores about $400k per quarter in lease repayments, so including those payments, the cash remaining might be more like $4.5 million, and their most recent quarter with cash burn of around $2.5 million.

Given the above scenario assumes a return to growth and strong cost control, I think that it’s more likely that Whispir would have raised capital even before three more quarters. But I think if it hasn’t raised capital 9 months from now, then a raising will be imminent.

With this analysis I have shown that even with decent growth in receipts, and doubling the rate at which the company reduces staff, marketing and corporate admin expenses, then Whispir will still reach a scenario where it has less than 6 months of cash burn, unless it also cuts marketing or software development spend.

Now, I do not have a strong view on whether Whispir shares are undervalued or overvalued, right now. However, I do take the view that Whispir will need to raise more capital within 1 year, whether by issuing shares or by accessing debt, for the reasons outlined above.

Ultimately, I believe investors generally do better spending their time on highly profitable businesses with a long track record of profit growth like this one, or at least up and coming businesses with sustained growth, already on the cusp of profitability. Whispir, far from being profitable, will likely be forced to choose between cutting expenses or raising capital at low share prices.

Sign Up To Our Free Newsletter

Disclosure: the author of this article has no position in Whispir and will not trade these shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.