HUB24 Limited (ASX: HUB) is a leading platform solution provider for wealth management organisations. It sells a software product that allows financial advisers to allocate clients funds across different asset classes such as shares, ETFs, managed funds, and alternative asset classes.

HUB24 Limited recently published its FY 2023 second-quarter trading update which revealed a slowdown in client inflows. HUB24 achieved $2.8 billion in net inflows for the December quarter, which is marginally down from the September quarter and a 23.6% fall from the prior corresponding period. Total platform funds under administration (FUA) now sit at $55.8 billion, making HUB24 the seventh largest wealth platform by FUA.

One highlight of the quarterly update is that, based on December numbers from HUB24 and competitors, HUB24 will become the number one platform in terms of the last twelve-month (LTM) net inflows. Fellow wealth platform disruptor Netwealth (ASX: NWL) has held this coveted title for several years. However higher-than-average December quarter outflows weighed Netwealth down. With a potential change in market leadership, I will analyse the current market dynamics and what it could mean for HUB24.

How Did HUB24 Take Market Share?

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services revealed an industry plagued by hidden fees, misaligned incentives and corporate greed. This left the reputation of incumbent platforms such as AMP (ASX: AMP), Colonial First Estate (CFS) and BT Panorama permanently impaired, creating an opportunity for independent platforms to grab market share. Indeed, HUB24’s market share went from 1.3% in FY 2019 to 5.7% today.

The disruptors, Netwealth and HUB24, focused on providing the best technology offering to advisers. The latest Investment Trends platform report crowned Netwealth with the best overall satisfaction and functionality, scoring 91.5%. However, HUB24 finished a close second, with a score of 91.1%. This is meaningfully above incumbent market offerings, with BT Panorama the closest, scoring 85.1%.

Despite the reputational hit and significant remediation bills, incumbents have largely retained their funds under administration (FUA), as you can see from the chart above. Outflows did occur, but positive market movement alleviated the damage. To me, this signals wealth platforms are a game of scale. The bigger the FUA, the harder it is to displace.

What Is The Wealth Platform Industry Structure?

Despite HUB24’s significant market share gains, its revenue margin, being the percentage it takes of FUA, has fallen from 0.57% in 2018 to 0.32% today. This is great for advisers and clients, but not so good for investors. Scale advantages, at least at HUB24’s current market share, need to be returned to clients via lower fees. This indicates low pricing power among competitors.

In a rational industry structure, this isn’t necessarily a bad thing. However, the Australian wealth platform market spreads $921 billion in FUA amongst several platforms.

Incumbents also look to be stepping up their game. A recent report by Finura said competitors are increasing investment in technology, which could erode the early gains made by HUB24. This is typified by private equity outfit KKR, which took a 55% stake in CFS, investing $430 million to upgrade systems.

“The real question on everyone’s lips is how many platforms this market can sustain with 15,000 advisers for the foreseeable future. According to Cerulli, the US has ~14,000 [advisers] with $102 trillion in regulatory FUM. These advisers direct 85% of all their assets to the top three custodians.” – Finura Group Wealth Tech Predictions 2023

“We expect further consolidation. It is a scale and technology battleground and net positive flows are becoming rare.“

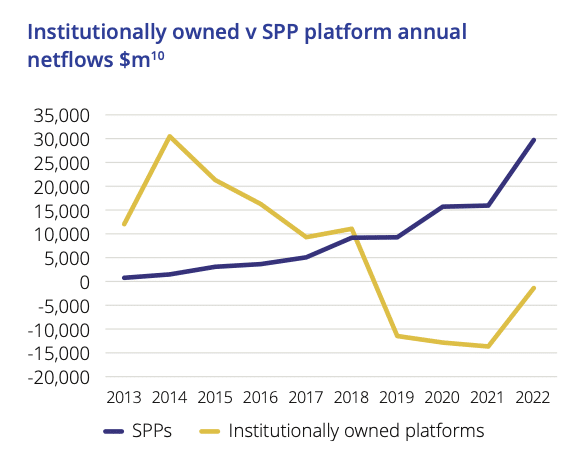

Furthermore, churn from the Royal Commission is waning. In 2019, incumbent wealth platforms BT, AMP, CFS and Insignia (including MLC and ANZ) lost $18.4 billion in net outflows. In 2022, that number has fallen to just $8.6 billion. Special purpose platforms (SPPs) such as HUB24 continue to take inflows, but institutions are beginning to turn it around.

In summary, the current market structure incentivises platforms to reduce prices and invest heavily in technology, in order to attract advisers and inflows. This could lead to a race to the bottom, which will disproportionately impact HUB24 given its lower FUA.

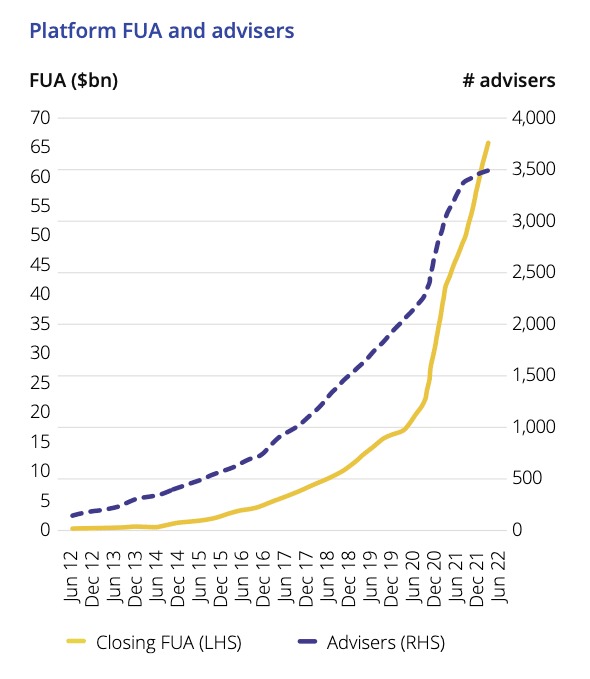

What Is HUB24’s Growth Strategy?

HUB24 has 75% of the 17,175 Australian financial advisers under licensee agreements, however, only 3,639 are on the platform. Advisers look to be underpenetrated, with an average FUA per adviser of around $15 million. Using industry averages, FUA per adviser is closer to $60 million (80 clients with an average FUA of $744,000). While it’s unlikely all clients need a platform, this does leave room for growth within the existing advice network. As more FUA joins the platform, HUB24 should benefit from scale where earnings grow faster than revenue.

HUB24 has also embarked on acquisition-led growth to diversify into adjacent financial services software. HUB24 purchased the self-managed super fund (SMSF) and trust software provider Class Ltd. The acquisition was expected to increase earnings per share by 8% and create $2 million in synergies. HUB24 is currently creating a combined SMSF offering with Class. However, this product could probably have been developed as a partnership, and didn’t require the acquisition of Class.

HUB24 also purchased Ord Minnett’s non-custody portfolio administration portfolio. This is an okay business, but is low growth and charges a fixed fee. Therefore it doesn’t scale nearly as well as the core platform division. Overall, I am yet to be convinced adjacent acquisitions are the best way to deploy shareholder capital.

In comparison, HUB24 also acquired $15 billion in FUA from Xplore for $60 million. Given the importance of scale, I am more impressed by this type of acquisition.

Will HUB24 Benefit From Higher Interest Rates?

When interest rates were zero, interest income derived from client deposits didn’t move the needle on earnings. But with the cash rate now at 3.10%, HUB24 will earn a cash spread of around 1.50%. Assuming a conservative 5% of FUA in cash (Netwealth recently reported 6.9%), HUB24 could be expected to earn around $41 million in interest income, which drops straight to the bottom line.

Are HUB24 Shares A Buy?

Based on current FY 2023 analyst estimates, HUB24 is trading on a price-to-earnings ratio of 55. The market values HUB24 as a growth company taking market share from legacy incumbents with inferior technology and impaired reputations. If it can maintain its current market leadership and keep adding new advisers and FUA on the platform, this will translate into higher profits and potentially make today’s multiple look reasonable in future years.

However, after evaluating the industry structure and the potential for incumbents to fight harder for market share, this valuation is too rich for me to invest. A further slowdown in flows or competitor’s technology catching up could change the market narrative and lead to a derating of the multiple.

Moreover, it’s possible there are too many platforms servicing the market already. This will likely lead to ongoing revenue margin pressures, or the need to scale via acquisition. As a result, I would need a greater margin of safety to compensate me for these risks, which HUB24’s current share price does not afford.

If you enjoyed this article, you might also be interested in our prior coverage of HUB24 competitor, Netwealth.

Disclosure: the author of this article does not own shares in HUB24 and the editor also does not. Neither will trade shares in HUB for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.