Accounting software company Xero (ASX: XRO) this morning reported the Xero results for H1 FY 2023, boasting strong half year revenue growth of 35% to $658 million, but a pathetic profit result, being a loss of over $16.1 million. The appalling profit result is particularly galling given Xero increased prices, and boasted a super strong gross margin of 87%.

The good news is that Xero continues to grow strongly, and it is pretty obvious that the Australian and New Zealand business would be very profitable on a standalone basis. On top of that, the company produced $16 million in free cash flow. It has plenty of cash, but also plenty of debt, and its net cash position is around $25 million, which is rather low. I’d argue that Xero’s easy access to low cost debt has been the main problem for shareholders, because these results make evident that the Xero board and management have pissed away at least part of that cash on value destroying acquisitions… all the while lavishing each other with praise.

Xero Writes Down Its Waddle Acquisition… Again

The main reason for the loss was a $25.9 million write down of Xero’s lunatic acquisition of Waddle, just 2 years ago, back in 2020. The Waddle acquisition is an example of the poor judgment outgoing Xero CEO Steve Vamos, who made a number of acquisitions, all of which degraded the (very high) quality of the Xero business (in my opinion), and none of which have obviously paid off for shareholders (as far as I can tell).

In the FY 2022 result, the carrying value of Waddle was written down by around $20 million, though the company at least “made” a deferred consideration gain of $30m in those results. Either way, this is not the first time we’ve found Waddle falling short of the fantasy.

On top of that, in the FY 2022 report, Xero disclosed that “The recoverable amount of the Planday CGU was calculated on the basis of fair value less costs of disposal in accordance with NZ IFRS 13: Fair Value Measurement. Fair value was determined using a revenue multiple of 12.2.” Given this is significantly less than the multiple of revenue that Xero itself is trading on, you’ve got to question this valuation too.

The point here is that this set of results makes clear beyond a shadow of a doubt that the current Xero board is completely focussed on growing revenue, even if that means losing money on acquisitions, and harming shareholders in the process. Given the share price performance, and worsening losses, in my view each and every one of them is overpaid for what is an absolute plumb job. I doubt there is any shortage of up-and-coming professional executives who could do their jobs for a lower price, and actually make the company profitable to boot.

Xero CEO Steve Vamos To Resign

When Xero CEO Steve Vamos took the helm in early 2018, the Xero share price sat under $40. Just a few months later, the company reported full year revenue of $406 million. That’s substantially below its half year revenue all these years later. And yet, the Xero share price has less than doubled in that period, and the business has just recorded a loss that is worse than the prior corresponding period. Despite years of trying, Xero still can’t grow profitably in the US or the UK, and I would not give Vamos an iota of credit for the strong performance in Australia and New Zealand, which was very much put in train by his predecessor.

I have no real view on the new Xero CEO, Sukhinder Singh Cassidy, but as a shareholder I’m more than happy to roll the dice on a new leader, given Vamos’ tendency to make bad acquisitions, and not even express regret about it. One concern I have is that Sukhinder Singh Cassidy serves on the board of notorious dumpster fire Upstart. Its stock is down 93% in the last year so it’s fair to say Singh Cassidy has experience at the top levels of a company that has absolutely pantsed shareholders in brutal fashion.

Xero Leadership Misses Expectations They Themselves Set

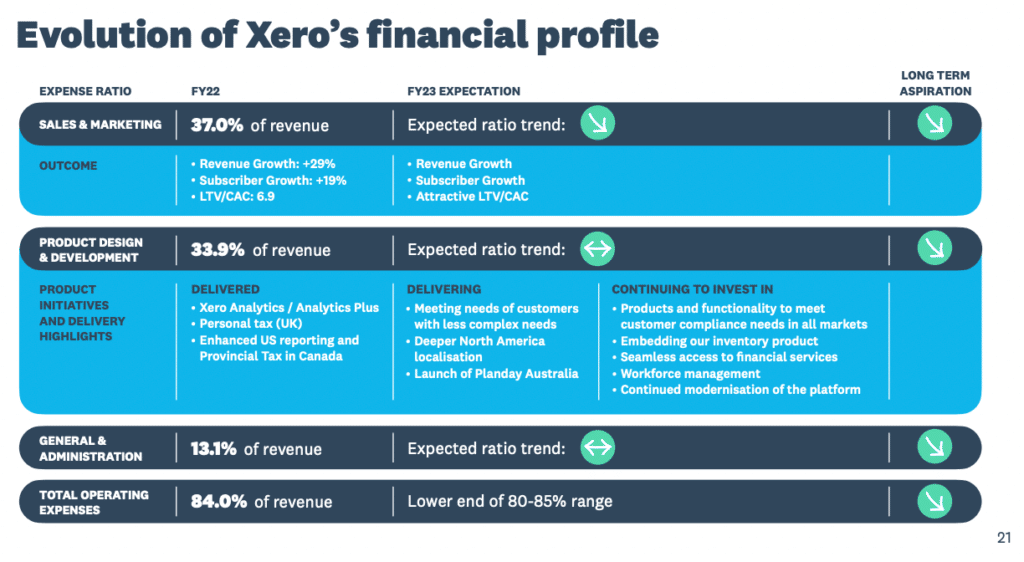

One of the most startling aspects of this Xero result is that it completely undermines the credibility of management. For example, lets take a look at slide 21 from the FY 2022 results presentation:

Now, as you can see, they clearly said that sales and marketing would fall as a percentage of revenue, and that product design & development would be flat. In the long term, they would “aspire” for both metrics to go down.

In reality, the company delivered on its reduction of sales and marketing, which came in at 36.3% but increased the product design and development spend to 35% of revenue. This is particularly galling because it is clearly a decision management can control, and it shows that they have made a conscious decision to disappoint expectations they themselves set. For me, that falls well below the kind of standards of decency I would expect from company management. There’s a simple solution here; spend less.

The lesson for investors here is not to trust what the leadership of Xero say they “expect”… even if it is in their control.

Xero Still A Very High Quality Business Despite Disappointing Xero Results

There is an apocryphal story that Warren Buffett once said a ham sandwhich could run Coca-Cola. I think that is approximately true for Xero’s Australian and New Zealand busines, where the prior management had already established Xero as a market leader and powerful platform for accounting software and related add-on apps. Some degree of stewardship is required to keep this leadership position going, but the hard work has been done.

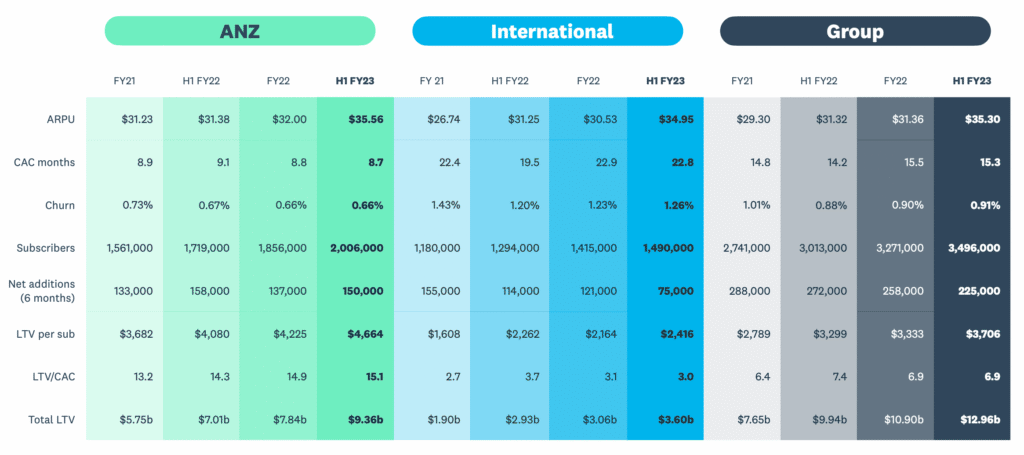

Rather, the challenge is to get genuine traction in the USA and the UK, and achieve attractive unit economics. As you can see from slide 31 in the FY 2023 presentation, below, the US and the UK remain very weak markets with relatively poor unit economics. And the most recent half saw international life time value to customer acquisition cost decline further, from 3.7 in the prior corresponding period, to just 3.

Now, this wouldn’t be a problem if Xero was making big profits due to its Australia and New Zealand businesses, but it’s not. It is spending all those profits on growing in international markets.

On the Xero conference call today, the Chairman David Thodey made clear the company would continue to pursue international growth. And that is fair enough. But to say the international expansion has been a success so far is simply wrong. Xero is struggling overseas, and its incredibly good quality Australasian business is subsidising the struggle.

Are Xero Shares A Buy?

Prior to these results, I would have said that Xero shares are well worth buying at the current price of $65. After all, the company is at roughly breakeven, has a small amount of net cash, and has annualised monthly recurring revenue of $1.48 billion. At the current share price of AUD $65, Xero has a market capitalisation of NZD $9.75 billion, putting it on about 6.6 times annualised monthly recurring revenue.

Now, if Xero management had any intention or inclination to make a profit, I daresay it would be pretty easy to make at 10% net profit margin. Within a few years of trying, it is very feasible that Xero could make NZ$150 million or more. At a market captialisation of $9.75 billion, that would put it on a P/E ratio of about 65, which I actually think could be actually be quite low relative to its potential. You see, I believe Xero could probably achieve net profit margins of 20% or even 30% at maturity. If Xero were modestly profitable, I think it would command a high P/E multiple, and probably deservedly (if management were focussed on steadily growing profits, rather than just revenue).

However, the sense I got from the conference call today was that there was no regret from management that the current results were disappointing, even though clearly the market is disappointed. There was no mea culpa about the acquisition write offs, and in fact I felt like that issue was swept under the rug. My impression was the attitude from management was more what I would expect if the share price was up 10% down considerably from highs, and dropping further. The congratulatory comments from the new CEO and old CEO respectively, when combined with the gratitude expressed to the old CEO from the Chair, gave the impression of a leadership team divorced from the reality of a market looking for profit growth.

Unfortunately, it seems that we can expect more of the same from Xero. The outlook statement says that “Xero will continue to focus on growing its global small business platform and maintain a preference for reinvesting cash generated, subject to investment criteria and market conditions, to drive long-term shareholder value.”

Personally, this pisses me off mightily because clearly under Vamos the investment criteria for reinvestment has been far from perfect. They are expanding internationally on a LTV to CAC of just 3.

Within a couple of years of buying Waddle, the company has written off the majority of the purchase price: they overpaid for a dud. I don’t want to get into each and every acquisition but suffice it to say that valuing an acquired company at 12.1 times revenue does not give me confidence in the company’s reinvestment criteria.

Moving forward, it is mind-blowing to me that the board would choose a new CEO who is on the board of Upstart. While the Upstart share price may be down 93%, but that is not surprising given its actual results, which are one of the worst dumpster fires I’ve ever seen on markets. In its Q3 results Upstart saw its gross margin drop massively, revenue down more than 30% (and below estimates) and cash burn doubling. Upstart looks like one of the worst performing $1b+ companies on a global stage, so prima facie, the appointment of an Upstart board member as CEO is a red flag for me.

As a result, I am downgrading my valuation of Xero. I think I will continue to hold my small Xero shareholding, but I am afraid that the new CEO may well run the share price lower, since she may have a mandate from the board to continue making losses. If Xero switches into profitable growth mode, I will very happily change my view, and upgrade my valuation considerably.

Based on the performance of Upstart, and the ongoing losses at Xero, I am not particularly interested in buying Xero shares right now, as I would prefer focus my investment on companies with management teams I have greater confidence in. On example of why I consider Upstart to be a poor performer is this Upstart shareholder class action against Upstart.

Notably, I could definitely change my view on the CEO if more information comes to light. However, given Upstart’s performance is stand-out bad, I don’t understand how Sukhinder Singh Cassidy’s role at Upstart is compatible with becoming CEO of Xero.

Furthermore, the CEO is incentivised to grow revenue more than the share price, in the announcement you can see that 40% of her long term stock grands are based on a service condition while the performance based component is “Compound Annual Revenue Growth (75% weight) and Relative Total Shareholder Return (25% weight).”

Overall, I think Xero remains a super high quality business but right now I think that the management, employees and board of the company are taking taking too much from shareholders. I think the business could easily make a profit but it looks like the near term priority is to grow revenue, even if that revenue growth comes at the expense of profitability.

Looking longer term, I think one day Xero will start being run for a profit, and when that happens, I believe it will more than justify its current share price. Therefore, I think it is rational to continue holding shares, even though I suspect the short term future will be disappointing. If nothing else following the story will help me notice when the company does start prioritising sustainable profit growth. For now, I’m more interested in these 5 stocks with good momentum.

Sign Up To Our Free Newsletter

Disclosure: the author of this article owns shares in Xero and will not trade them for at least 2 days. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.