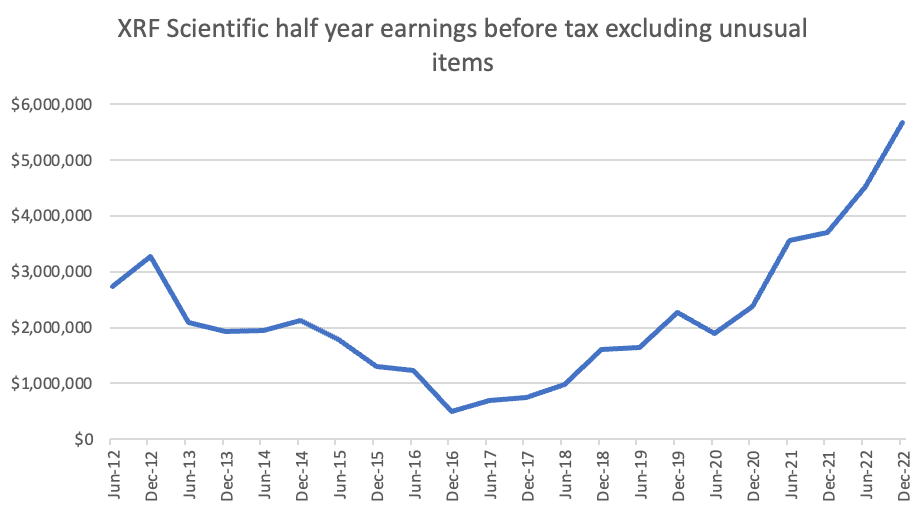

Yesterday afternoon mining services company XRF Scientific (ASX: XRF) reported its half year results. In H1 FY 2023, revenue grew 46% to $27 million and net profit after tax grew 34% to $3.9 million. Earnings before tax came in at $5.7 million, a new half year record. The chart below shows XRF Scientific’s earnings before tax over the last ten years.

As you can see above the last few halves have shown strong growth. Yesterday’s record result corresponds with “very strong demand from mining and industrial customers.” One concern I have is that XRF Scientific might be a very cyclical business, and that profits could fall in the event of a mining downturn.

I am just in the process of getting to know this business, having been slow to the story. My first article ever about it was only a few months ago when I covered 5 Stocks With Good Share Price Momentum and Earnings Growth in November. After writing that article, I bought shares myself, in accordance with my disclosure.

Nonetheless, it is always impressive (and well worth noting) when a company achieves record profit in each of its three segments. I call this occurrence a synchronous bloom. Let’s take a look.

As you can see below, from the company presentation, XRF Scientific achieved a record $2.53 million in profit before tax from selling its consumable products, in H1 FY 2023. This was an excellent performance, though the company noted that “Profits increased due to high product volumes and additional margin earned on previously ordered low-cost raw materials that were part of our large inventory position.” This may suggest profit growth will be harder to come by next half.

XRF Scientific Consumables Segment Profit Before Tax

Next, the Precious Metals division, which sells products for the laboratory and industrial platinum alloy markets, also achieved a record result, contributing a segment profit before tax of $1.61 million. The company said it was experiencing “continued strong demand from mining and industrial markets, for both new product and recycling sales.”

XRF Scientific Precious Metals Segment Profit Before Tax

Finally, the company had a bumper half when it comes to sales of capital equipment, achieving a segment profit before tax of $1.54 million. Managing Director Vance Stazzonelli wrote that, “Demand for our capital equipment products was robust, which is expected to continue into 2H23. In January 2023 our order book reached a new record level, with production for some products booked out past 2H23…” This result benefitted from a full half of PBT contribution from the acquired Orbis Mining, which contributed $684k during H1 FY 2023.

XRF Scientific Precious Metals Segment Profit Before Tax

XRF Scientific Cash Flow and Balance Sheet

Beyond that, it’s certainly worth noting that XRF Scientific (ASX:XRF) generated free cash flow of around $2m, which was negatively “impacted by increase in Consumables division stock position of $1.0m due to lithium production chemical price increases.” This is a reminder that it is a reasonably capital intensive business, carrying inventories of about $16.8 million, being more than a couple of years worth of profit!

Of course, the historical profit growth would appear to easily justify the investment, and the balance sheet looks healthy with $6.0m in cash and $3.1m in debt at 31 December 2022. The company noted that in the consumables division “Inventory levels increased by $1m during 1H23 which is lower than forecast range of $2.3-2.8m.” This may imply further investment in inventory is required.

Having said that, one could certainly be worried that demand weakness might see profits in the consumables division decline significantly. Perhaps it is just because I’m late to the story, but I cannot shake the thought that demand for both consumables and capital equipment could see profits go backwards one day.

Of course, the multiple of earnings is hardly mind-bending. The company generated earnings per share of 2.8 cents in the first half. If this were to be repeated, earnings per share for the full year would be 5.6 cents. At the current XRF Scientific share price of 99 cents, that would put the company on a P/E ratio of 17.7.

I don’t have a view on the fair value of the stock, as I simply haven’t spent long enough thinking about the company. However, I believe a synchronous bloom (where 3 or more operating segments all produce record profits in the same half) is always worth looking at.

I am mindful that a synchronous bloom is quite rare for XRF Scientific, and could stimulate the market to award the stock a higher multiple. On the one hand, that means I think XRF Scientific will be catching the eye of more investors. On the other hand, I’m mindful that it’s very difficult to repeat a synchronous bloom; but that might be exactly what buyers are expecting.

I have not decided if I like the price, but I do like the bouquet.

Disclosure: the author of this article owns shares in XRF Scientific, and will not trade XRF shares for at least 2 days after publishing this article. However, he reserves the right to buy or sell after that. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter