Three ASX stocks are in the running to win the Australian Exporter of the Year for 2023. In 2006, ResMed (ASX: RMD) clinched the award and Cochlear (ASX: COH) won the following year. If you had invested when each business won and held on, you would have achieved a share price compounded annual growth rate (CAGR) of around 13.5% and 10.8% to date. Not all winners end up being multi-baggers though. The enigmatic artificial intelligence labour hirer Appen (ASX: APX) won in 2008. Listing on the ASX in 2015 at around $0.53 cents per share, the Appen share price peaked as high as $43 per share but now sits at around a dollar per share. The following three ASX stocks have the potential to emulate the success of past winners but risks exist, so this article should only be thought of as a starting point for further research.

Audinate (ASX: AD8)

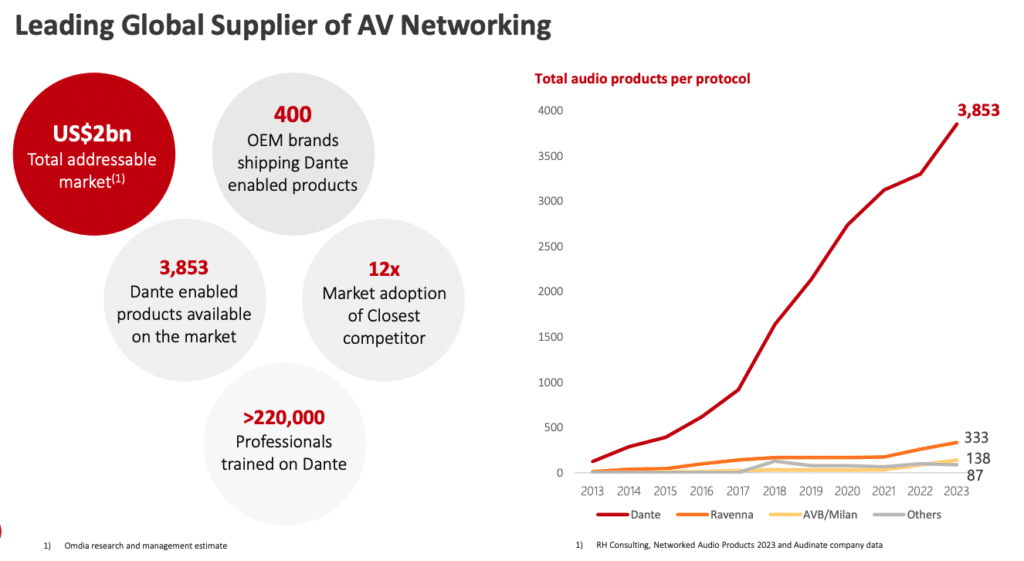

The Audinate share price has already soared at a CAGR of 34% since listing in 2017. Audinate produces chips, modules and software to optimise the interaction between different audio and visual devices. In the audio devices market, Audinate has become the de facto standard. Audinate is striving for the same success in the video devices market.

Source: Audinate AGM Investor Presentation

Audinate produced its strongest results in FY 2023 resulting in a sudden appreciation of its share price from $9 to $14 per share. Revenue per employee reached an all-time high of $354,000 and employee expenditure per employee was $150,000. So, each employee generated around $200,000 in value for the business. The focus on a per-employee basis is informative in my view because salaries are the biggest cost for Audinate. However, investors are valuing Audinate at a market capitalisation of around $1.14 billion, suggesting both revenue per employee and the number of employees will grow. I find it hard to rationalise such a valuation, but there is no doubt Audiante is already demonstrating its valuable intellectual property.

Investors seem to be pricing in a great deal of value creation from Audinate employees. The other risk relates to Audinate’s total addressable market. The Infocomm conference is the biggest audio-visual conference for original equipment manufacturers and end users. Before the pandemic, the number of exhibitors has hovered between 900 to 1,000. Earlier in June, there were only 760 exhibitors. It’s worth monitoring this number in the next few years because attendance should reach normalised levels. If not, it may suggest Audinate’s customer market is consolidating, meaning each individual customer may have more market power.

Whilst there is ample runway for growth given that around 400 OEM brands are using Audinate’s product, you could argue it should currently be more profitable with higher profits since it has penetrated nearly half the target market in audio. Audinate seems to be a high-quality business with a hefty price tag.

Prophecy International Holdings Limited (ASX: PRO)

Prophecy is quite different from when it was first listed in 1998. Instead of developing and acquiring a wide range of different software solutions, it pivoted towards cyber-security monitoring and performance analytics for call centres from around 2017.

The performance analytics solution targeting call centres is called eMite and was acquired by Prophecy for a fair value purchase consideration of $14.9m in July 2015. In FY 2016, eMite generated revenue of $3.95m and recorded an operating loss of $417,150. It was founded by Stuart Geros in 2003 who is the Vice President of sales in Asia-Pacific. EMite recorded $10.9m in revenue for FY 2023, demonstrating around $1m in revenue growth for each year since Prophecy bought it.

In 2017, Prophecy entered into a partnership with Telstra to sell eMite as an add-on solution. Telstra uses the Genesys’ contact centre cloud platform, so consider eMite as a specific functionality focused on collating data across disparate systems to improve performance. Genesys is a giant American software company that recently generated $US 1.2 billion in annual recurring revenue in the second quarter of FY 2024 and holds $US 600m in cash. The significant size difference demonstrates how small of a cog wheel Prophecy is in the overall call centre solution.

Although small, eMite is important because its customers normally use multiple software platforms to deliver a given customer experience. These platforms often don’t talk to each other, but eMite can speak to all of them and synthesise key insights to improve performance. EMite has been a sound pivot to date but my biggest concern is that the biggest customer experience platforms could develop an all-in-one-solution.

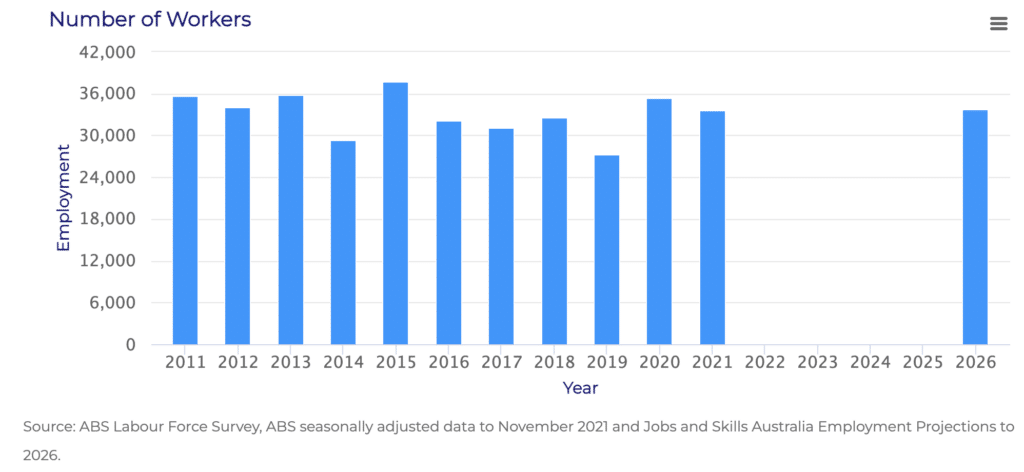

I think the number of call centre employees is valuable to monitor. I’m unsure how this will pan out in the future, perhaps the rise of e-commerce may drive demand for call centres. But then you have artificial intelligence to contend with which could potentially diminish the value of call centres. The below graph shows the number of call centre workers employed in Australia and a forecast for 2026 by Jobs and Skills Australia.

Despite potential risks, Prophecy is still one ASX small growth stock that could be a hidden gem, as covered by Nick Maxwell.

SDI Limited (ASX: SDI)

SDI Limited manufactures, develops and sells specialist dental materials to dentists in over 100 countries. It was founded in 1972 and listed on the ASX in 1985 yet its market capitalisation is only around $99m. How does an Australian Exporter Award nominee with such a long history be valued so low?

SDI’s earnings per share rose as high as 8 cents in FY 2021 but it’s fallen back to the same levels from a decade ago. For a long time, SDI was the leader in amalgam dental solutions, the little silver-looking pieces that get filled in your crowns when you’ve had one too many lollies. However, after research revealed that mercury in amalgam posed potential health concerns in 2017, SDI pivoted to aesthetics and teeth whitening.

Aesthetic solutions are composite resin fillings, which are made of a type of plastic reinforced with powdered glass filler. The growth in aesthetic revenue has more or less offset the decline in amalgam revenue. And the popularity of teeth whitening has been increasing as celebrities and influencers optimise their appearance.

Source: SDI Limited Investor Presentation FY 2023

Don’t be fooled by the resurgence of amalgam sales in FY 2023. It was primarily due to competitors pulling out of Europe as a result of the increase in legal safety requirements for dental amalgam capsules. SDI captured market share in Europe but one that is undergoing secular decline.

SDI generates most of its revenue in Europe followed by North America and then Asia-Pacific. However, Australia reels in profit before tax margins of 22%, around seven times that of Europe and the USA respectively. I believe the biggest reason for such a large discrepancy is that SDI faces less competition in Australia and is less reliant on third-party distributors.

A review of SDI’s list of distributors for Australia shows it only uses one third-party distributor, Henry Schein Halas (NASDAQ: HCIS), the biggest dental supplier in the world. Whereas in Europe and North America, the list of distributors is long. Given SDI’s long history in Australia, its reputation reduces the need to rely on distributors, but Europe and North America present different battlegrounds.

It’s interesting to note two US competitors, Dentsply Sirona (NASDAQ: XRAY) and Envista Holdings Corporation (NYSE: NVST) have performed poorly. Readers should note dental equipment and software form a significant portion of their revenue base, so they’re not like-for-like comparisons. In contrast, distributor Henry Schein Halas has consistently recorded much higher returns on capital. Henry Schein Halas appears to be enjoying strong scale advantages whereas the dental product manufacturers compete on product differentiation at the expense of sustainable returns on capital.

SDI is planning on moving its manufacturing operations to a bigger and more automated facility. Management appears confident in the future and claims this will provide operational efficiencies. SDI estimates this to cost $45m in land and property acquisition and $15m for plant and equipment. It’s anticipated to finish by 2027, so this process of investment may hamper earnings for some time.

SDI may be a great Australian exporter but not a sound investment. Given SDI’s dominance of Australia, future upside potential lies in Europe and North America. But this depends on distributors that in my view capture greater returns across the value chain. I think it will be difficult for SDI to find a way to differentiate itself in a much more crowded space filled with distributors that possess greater negotiating muscle.

Lock It In

The winner will be announced on 30 November at the national ceremony.

Disclosure: the author of this article does not own shares in or have a position in any of the companies mentioned. The editor of this article does not own shares in or have a position in any of the companies mentioned. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.