Quarterly season is upon us with most small-cap growth companies updating shareholders on the quarter to December 2020. I have taken advantage of quarterly reporting to update my notes on Alcidion (ASX: ALC), Secos (ASX: SES) and Whispir (ASX: WSP).

Please remember that these are notes on the companies’ recent results only and should not form the basis of an investment decision. While this article does cover developments at three listed companies, the article is not financial advice, it is general in nature, and our disclaimer is here.

Alcidion Group Ltd (ASX: ALC) Q2 FY 2021 Quarterly Report (Appendix 4C)

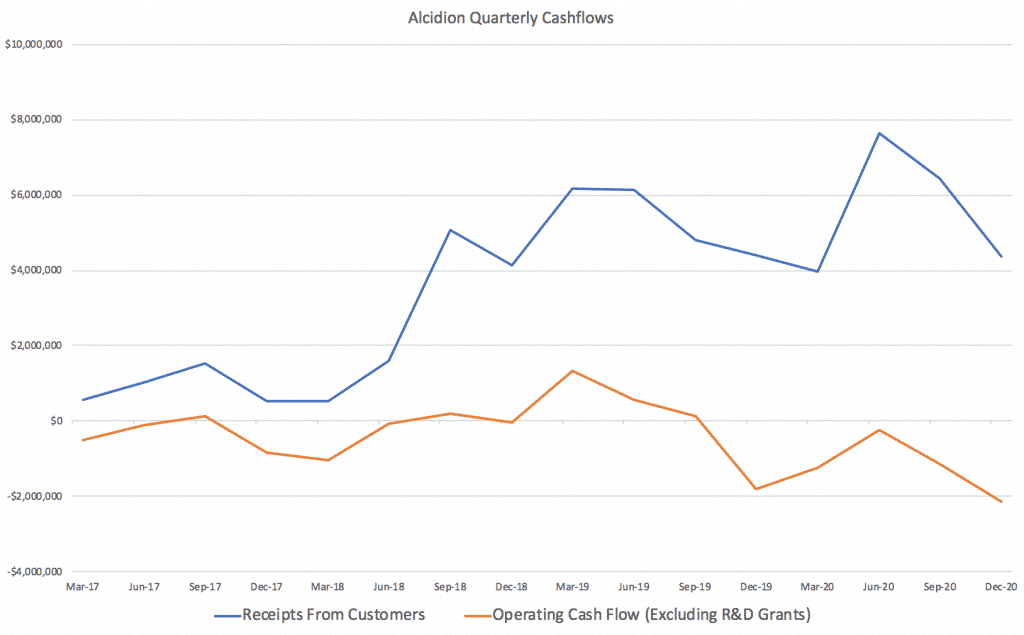

Alcidion has pleased the market lately by announcing a big contract win, and the share price climbed further when it was recommended by a newsletter. However, you can see below that its actual cashflow wasn’t great in the most recent quarter.

However, this result suffered from the fact that the company received $3m from on client “on the first business day in January 2021 instead of as expected in late December.” Had this $3m been received in December, the quarterly cashflow would have looked a lot better (and indeed, quarterly operating cashflow would have been the second best ever for the company).

Based on the company’s progress so far in FY 2021, it is expecting to recognise at least $14m of recurring revenue during the year. In FY 2020, the company booked $10.4m. If we conservatively assume no further recurring revenue is added, that still amounts to recurring revenue growth of 40%. This is consistent with a growth thesis and puts the company on about 15x FY 2021 recurring revenue at the current share price of 22 cents. I have not traded shares since the quarterly report was released and consider the long term growth thesis to be on track.

Secos Group Ltd (ASX:SES) Q2 FY 2021 Quarterly Report (Appendix 4C)

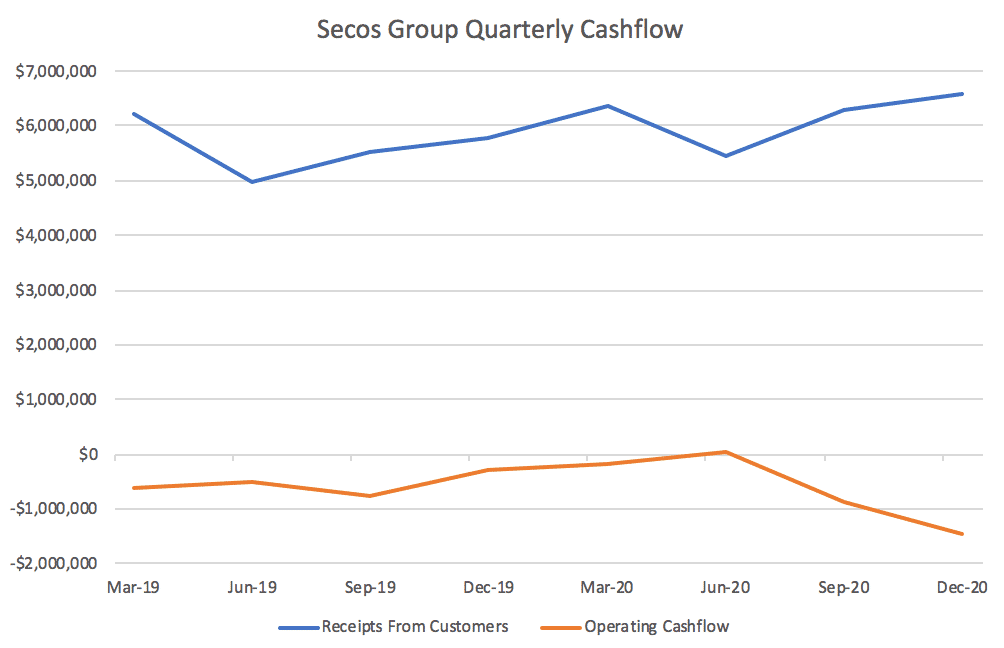

This morning, Secos (ASX: SES) reported its quarterly results boasting sales of $7.9m were up 50% on the prior corresponding period and 34.2% on the preceding quarter. However, as you can see below, this has not been reflected in the receipts from customers, which were only slightly up quarter on quarter.

The company mentioned that its operating cashflow was impacted by “investing over $2.6 million in new working capital to support increasing sales volumes”. The company has over $14m in cash, so I am not too concerned about the weak operating cashflow in this quarter. It would have been nice to see some of that strong revenue growth reflected in receipts from customers, but the company said “This will normalize as customer

payments fall due according to standard industry credit terms”.

In the Ausbiz video from November below, I explained why I owned shares in Secos Group, and in this post I explained my inflection point thesis.

Claude, Rudi and David chat about ASX:SES from Claude Walker on Vimeo.

However, the share price is almost 50% higher than when that video was recorded, and the company now has a market cap of about $148m. Secos has yet to make a maiden profit, and only once it has some sustained profitability will I be able to value it with greater confidence.

However, even if ends up making $5m on profit on $50m revenue (which would be very respectable growth from its current position) then it would be on 30x earnings. Because I need to make such optimistic forecasts to justify the current price, I’m no longer that attracted by Secos Group. After all, it is up around 90% since I included it in my article called 4 Microcaps I Bought This Week.

I recently took some profits at 24.5c per share and while I continue to hold shares at the time of writing, I am considering selling the stock.

Whispir Ltd (ASX: WSP) Q2 FY 2021 Quarterly Report (Appendix 4C)

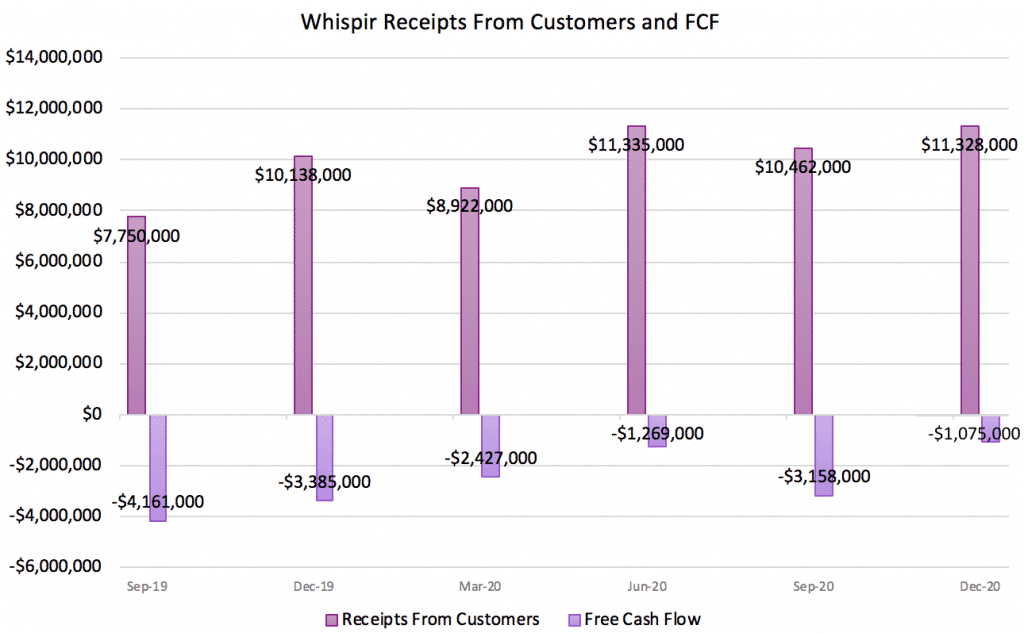

Last week, business-to-consumer communications provider Whispir (ASX: WSP) reported its quarterly growth, showing considerable improvement since we first covered Whispir shares in May 2020.

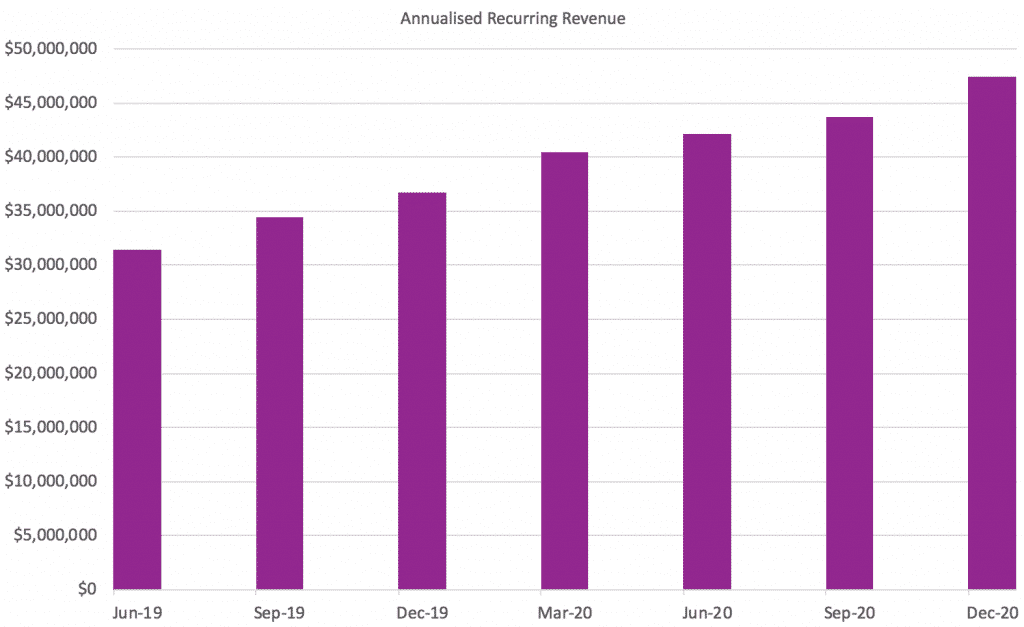

The highlight was probably Whispir’s annualised recurring revenue (ARR) of $47.4m which increased by $3.7m quarter on quarter. That increase was better than the growth in the last couple of quarters.

Receipts from customers were reasonable and cash burn (being negative free cash flow) was an improvement and not a worry, given the $10.8m of cash they have.

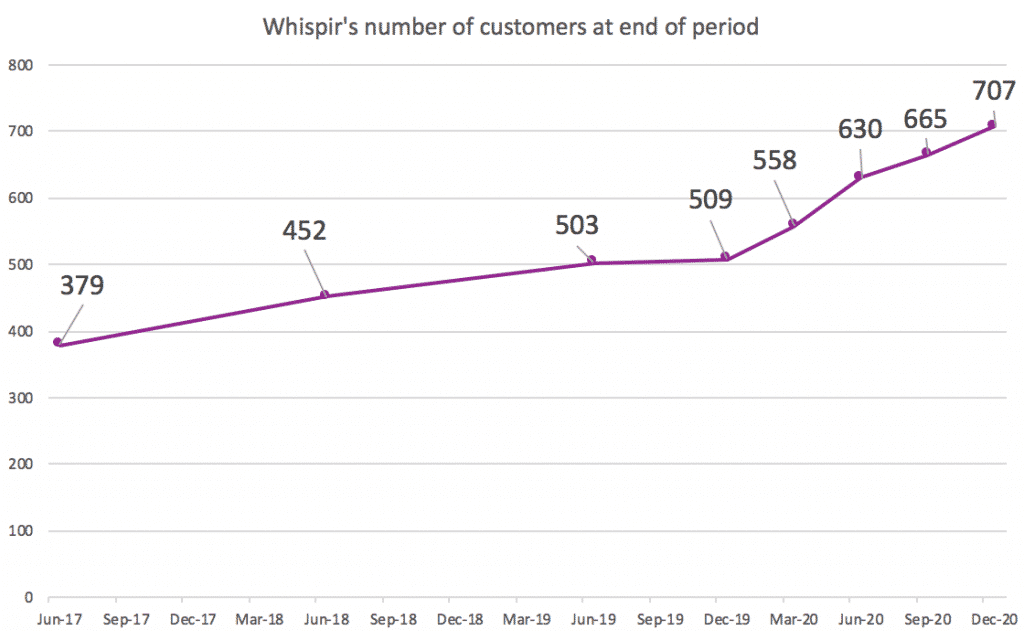

Customer growth also continued, although I’m not sure how useful this metric is, especially considering Whispir’s willingness to serve customers who vary greatly in size.

Overall, there was nothing particularly impressive in this quarterly result. True, the ARR growth was slightly better than I would have expected based on the last couple of quarters. However, prior to this quarter the best increase in ARR over the last couple of years was in the March 2020 quarter. For that reason, the headline 29.2% year-on-year growth rate it can boast now is unlikely to be maintained; even a record incremental increase could see growth rates drop given the stronger prior corresponding period.

In the mean time, though, the market likes the news and has pushed the company to a market cap of $425m at the share price of $4.10. That’s around 9 times annualised recurring revenue. Even keeping in mind Whispir has lower gross margins than many software companies, that doesn’t seem unreasonable. I have not traded any shares since the quarterly report and continue to hold for now.

Disclosure: I own shares in all three companies referenced above, none of this article is intended to be financial advice, and the information is general in nature.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive an occasional Free email with more content like this, then sign up today!