IntelliHR (ASX:IHR) Spouts Optimism In Its FY 2021 Results

The IntelliHR stock price has been on a wild ride ranging from 59c to 20c in the last year. In contrast its ARR is only increasing (strongly).

The IntelliHR stock price has been on a wild ride ranging from 59c to 20c in the last year. In contrast its ARR is only increasing (strongly).

The Objective Corp FY2021 results were very strong but do they justify the 58% share price gain in the last year?

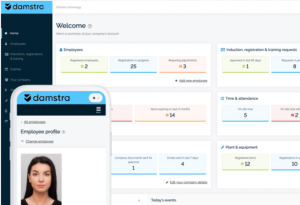

Unfortunately for shareholders, Damstra’s stretched balance sheet is overshadowing its high margin annualised recurring revenue.

These three companies report quarterly, but their Annual Reports still offer a valuable window into the company.

Motley Fool probably caused the Dicker Data (ASX:DDR) share price to drop on Monday, because they issued simultaneous sell recommendations.

The ASX:ACL share price hit all time highs after its upgraded 1H FY2022 guidance, so high covid testing volumes are making ACL stock go up.

Dicker Data (ASX:DDR) continued its excellent operational performance in the half to June 2021; but are the shares still priced attractively?

Ambertech (ASX:AMO) is up 40% so the value thesis has played out.

Kip McGrath Education Centres saw a strong increase in gross profit in the second half but employee expense growth hampered the result.

The Nanosonics share price is up over 20% on results, thanks to a much stronger second half. So is it time to take profits?

There’s no doubt Audinate (ASX:AD8) is a high quality small cap with an ever-improving sustainable competitive advantage. But is the stock too expensive or still cheap?

FY 2021 was a Synchronous Bloom for Energy One (ASX:EOL) but growth will be harder to find in FY 2022.

Corum is at the start of a new journey. At 4.2x healthcare revenue, the market doesn’t believe the story. So Corum needs to prove it can grow.

ASX superstar stock Pro Medicus (ASX:PME) has reported record results for FY2021, but how does the future look?

ASX listed healthcare stock EBOS Group (ASX:EBO) reports solid earnings per share growth and has increased its dividend accordingly.

Fiducian Group (ASX:FID) has reported record results in FY2021 and continues to increase dividends to shareholders.

I wrote to small-cap companies asking when they expect to report. Here’s what I found.

The Dicker Data share price moved considerably today because it announced a decent acquisition in New Zealand.

Corum and Rightcrowd report increasing cash burn in their quarterly cashflow and 8Common has reported a material contract win.

Ansarada shares continue to trade on around 4x revenue, which is very low compared to other ASX listed software stocks.