The Flaw In Macquarie Bank’s Sezzle (ASX:SZL) Coverage

Macquarie notes that Sezzle’s Appstore ranking has improved, but their analysis barely scratches the surface. Are Sezzle (ASX:SZL) shareholders in the dark?

Macquarie notes that Sezzle’s Appstore ranking has improved, but their analysis barely scratches the surface. Are Sezzle (ASX:SZL) shareholders in the dark?

These three stocks have seen insider buying and have decent prospects in the next few years.

Eroad’s FY2021 results showed weak half-on-half revenue growth, but there are signs of an exciting future.

In this video, I explain why I’m currently accumulating Nanosonics shares…

Appen (ASX: APX) shares are a potentially interesting investment, but investors should focus on the key drivers of the business, not EBITDA multiples.

While investing in the future is the best long term strategy, buying lower quality stocks like Ambertech (ASX:AMO) and Yellow Brick Road (ASX:YBR) can still pay off.

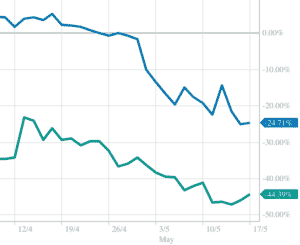

The EML Payments (ASX:EML) share price is down around 34% on regulatory concerns that could undermine its reputation globally.

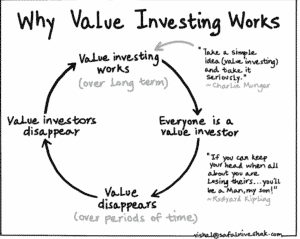

Investing is a long term game but shorting is not investing, and it is not long term!

With a P/E of around 8, this business is either unsustainable, or cheap; welcome to the world of the “value investor”…

With the share price now well below my purchase price it’s time to check in on what went wrong…

One of the easiest ways to get started as an ethical investor is to buy one of these ASX listed ethical ETFs.

These 2 under the radar micro-caps may be high risk, high reward, but they seem to be heading in the right direction.

Corum Group improved its cash burn during the quarter, but shareholders might have to wait a while for organic top line growth to resurface.

AVA Risk, Eroad and Audinate are all ASX small caps worth following, given their long term business growth.

My original Whispir (ASX: WSP) thesis has played out nicely but I no longer find the risk vs reward attractive.

We bought a beach house, so I’m cashing out some of my stocks.

Less than a year after we published “The Case For Alcidion” the stock is up 160%, so it’s time to revisit the thesis.

Dusk Group (ASX:DSK) isn’t the kind of software compounder I love most, but it is arguably a short term trade set up…

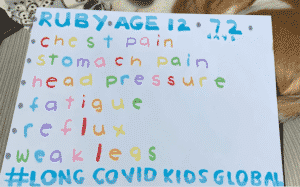

Adir Shiffman, executive chairman of Catapult International, has been sharing some interesting tweets about covid-19.