Volpara (ASX: VHT) Q4 FY 2022 Strong But Outlook Cloudy

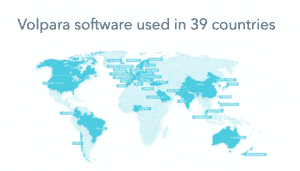

Volpara (ASX: VHT) has experienced impressive growth in annualised recurring revenue over the last five years; but it’s still uncomfortably far from profitability.

Volpara (ASX: VHT) has experienced impressive growth in annualised recurring revenue over the last five years; but it’s still uncomfortably far from profitability.

Plus, closer a look at how many shares each Energy One director owns, and the tenure of CEO Shaun Ankers.

A detailed look at the Pro Medicus major customer list, and why it needs both integrated delivery networks, and academic teaching hospitals.

Warren Buffett liked to invest in businesses with these two key features, during the high inflation of the 1970s and 1980s.

These 5 well established businesses have all seen insiders snapping up shares at close to or above current prices.

The Russian invasion of Ukraine, covid, and low rates have lead to significant commodity price increases across the board.

EarlyPay (ASX: EPY) is growing profits strongly and recently upgraded guidance, but the business still faces notable risks.

Veem Ltd (ASX: VEE) is an ASX company that sells gyrostabilisers for medium and large boats, to a global customer base.

Strong growth in H1 FY 2022 supports the view that Objective Corporation is one of the highest quality ASX business, but can it justify the share price?

As a general rule, I try not to sell anything on big sell off days. Rather, I bottle up the impulse and let it out on a day when the stocks are bouncing (if at all).

Kip McGrath Education Centres (ASX: KME) is on the verge of reaping the benefits of its corporate centre strategy.

PTB Group (ASX: PTB) achieved record revenue in H1 FY 2022 but longer term growth will rely on acquisitions…

Dicker Data (ASX: DDR) achieved another year of very strong profit growth, assisted by the acquisition of Exeed.

Camplify revenue growth of over 100% will catch investors eye, but the devil is in the detail…

Symbio is setting itself up for acquisitive growth in Asia, but the stock is arguably priced for perfection.

Sequoia Financial Group (ASX: SEQ) reported strong growth and has a very believable plan to keep it going for years to come.

The Ebos Group half year report showed decent growth, both organic and through acquisitions. But the Ebos share price is up, leading to a lower dividend yield.

My analysis of the Pro Medicus half year results suggest that the business is improving in quality as it grows.

Here is a list of ASX Small Cap Stocks results reporting dates, plus links to their results presentations, collated for your convenience.

The Audinate (ASX:AD8) H1 FY 2022 results were subdued at first glance, but key metrics imply the business continues to improve in quality.