Alcidion (ASX:ALC) Reports Free Cash Flow In Q4 FY2021 and Promises Profits

The Alcidion share price gained as much as 16% today after it released its quarterly results to June 2021.

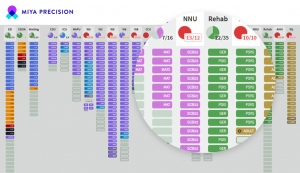

Alcidion Group Ltd (ASX: ALC) is a medical software company specialising in patient flow software for hospitals. Basically, Alcidion’s Miya platform makes it easier for nurses to manage beds in wards, and ensures that the appropriate medico has assessed test results, and taken appropriate action. Alcidion can be seen as an important software partner for public healthcare systems such as Australia’s Medicare, and the United Kingdom’s NHS.

The Alcidion share price gained as much as 16% today after it released its quarterly results to June 2021.

Less than a year after we published “The Case For Alcidion” the stock is up 160%, so it’s time to revisit the thesis.

Alcidion shares are trading at near to all time highs, the business is growing recurring revenue, and it’s winning new contracts in the UK.

The Alcidion share price, Whispir share price, and Secos share price all climbed after they reported quarterly results. Here’s why…

When will the “healthcare innovator” stocks be released?

Rudi was running a little late for our episode of The Call on Friday, so I had a chance to share some thoughts on Appen (ASX: APX). During the show we talk about CSL (ASX: CSL) and I mention my newfound interest in SomnoMed (ASX: SOM) as it begins a turnaround process. We also talk … Continued

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

The Alcidion (ASX:ALC) share price is up this morning on news of a $9.5m contract win, but how much is for selling a different company’s software?

Organic growth looks lacklustre but can recent investment in sales and marketing put a rocket under this business?

Reflections on the volatility and a stream of consciousness rumination on 5 stocks I like now.

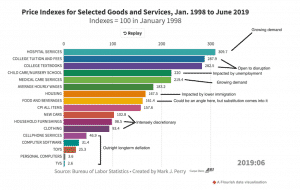

The current macro-economic settings makes it easy for bad creditors to borrow, and even easier for resilient well-run businesses with secular demand tailwinds.