Netwealth achieved another record earnings result in H1 FY 2023, with management flagging higher future profits as operating leverage kicks in. It was Netwealth’s first set of financial results under sole managing director Matthew Heine, who previously shared the position with his father, Michael Heine. If you’re new to the business, read our previous coverage on Netwealth improving its market share. At a share price of $13.90, Netwealth has a market capitalisation of $3.4 billion.

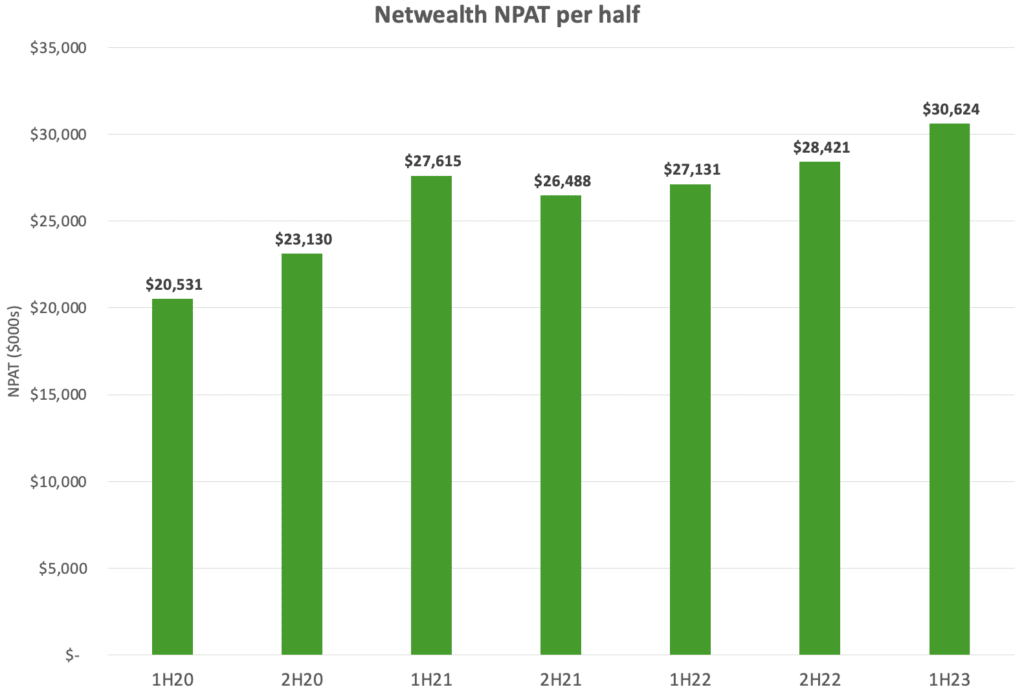

In the H1 FY 2023 results, Netwealth grew its revenue by 18.9% to $102.9 million and its net profit after tax (NPAT) grew by 12.9% to $30.6 million. Free cash flow was $34.1 million up on $28.1 million in the prior corresponding period. Note this has been calculated by subtracting investing cash outflows and lease repayments from operating cash flow. This does not reflect the free cash flow figure the company presents (derived from “underlying” operating cash flow before tax and interest). Netwealth held $98.7m in cash and no debt at the end of the period.

Netwealth’s Funds Under Administration

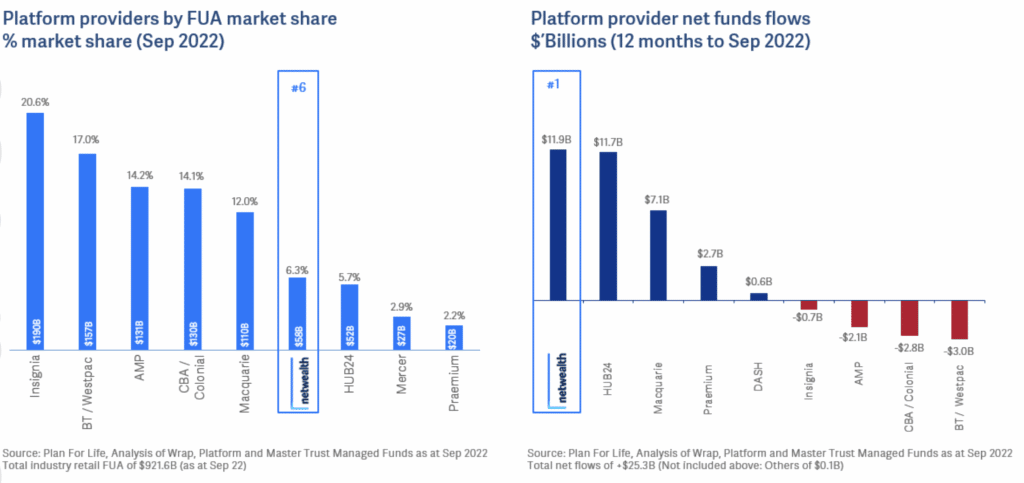

Netwealth increased funds under administration (FUA) by 10.2% over the past year to $62.4 billion. Net inflows of $10.3 billion were partially offset by a negative market performance of $4.6 billion. Netwealth continued to add new advisers to its platform, with financial intermediaries up 5.1% over the past year. New client accounts increased by 13.0%. Netwealth’s total market share is now 6.3%, up from 5.2% in H1 FY 2022.

Netwealth Signals Higher Earnings

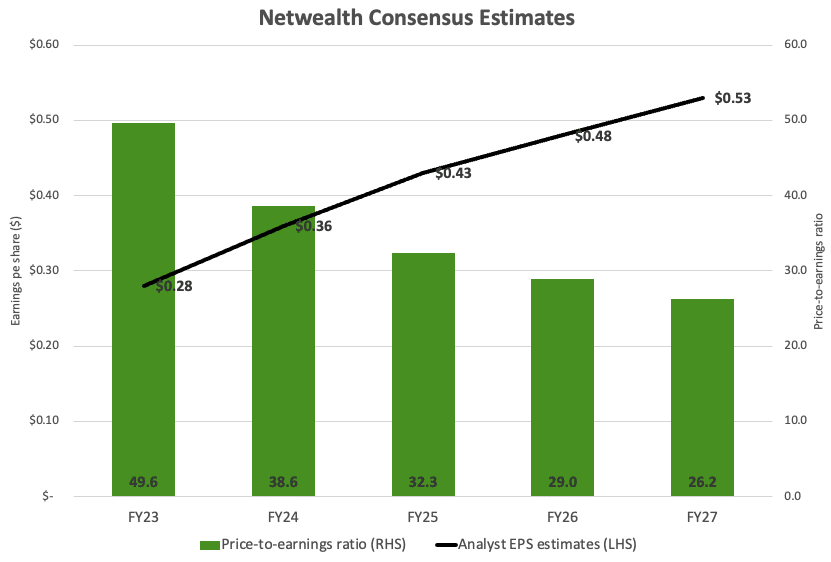

Netwealth’s NPAT has stagnated in recent results as the business invested in technology and personnel to support platform growth, as you can see below.

On the investor call, managing director Matthew Heine said the team is largely set with key areas built out. The focus would turn to optimising these resources. Netwealth said non-employee expenses would remain stable in H2 FY 2023. Headcount growth will be consistent with the first half.

“After a period of increased investment in our people, resources and technology our focus is now on driving productivity, efficiency, and operating leverage, which are important for ensuring sustainable growth and profitability.” – NWL H1 FY 2023 Presentation

Netwealth increased its interim dividend from $0.10 per share in H1 FY 2022 to $0.11 per share this half. At a share price of $13.90, Netwealth trades on a 1.51% dividend yield.

Netwealth’s Inflow Guidance

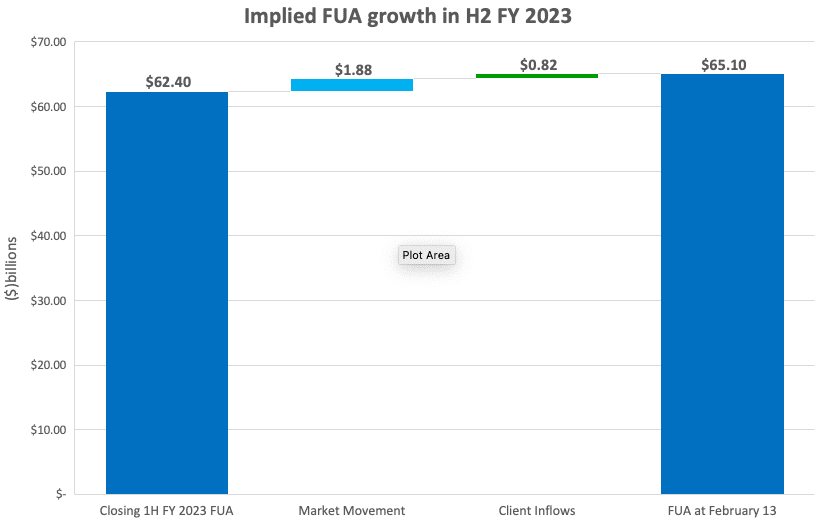

Netwealth reported FUA of $65.1 billion on February 13. Netwealth had net inflows of $5 billion in the first half, so it will need $6 billion in the second half to reach its FY 2023 guidance of $11 billion. Heine said on the call a proxy for market movement is a balanced portfolio. The Vanguard Diversified Balanced Index ETF, which is a 50/50 split between bonds and equities, has increased by 3.02% this year.

Using this ETF as a proxy for market movement would imply 2H FY 2023 net inflows of $820 million. This is behind the required cadence to hit guidance. Ideally, Netwealth should have net inflows of $1.5 billion midway through February. It should be said January is likely a slow month and inflow momentum should return in the months ahead. Nonetheless, I would have more confidence in guidance if the growth so far in calendar year 2023 were stronger.

Why are Netwealth’s Client Inflows Decelerating?

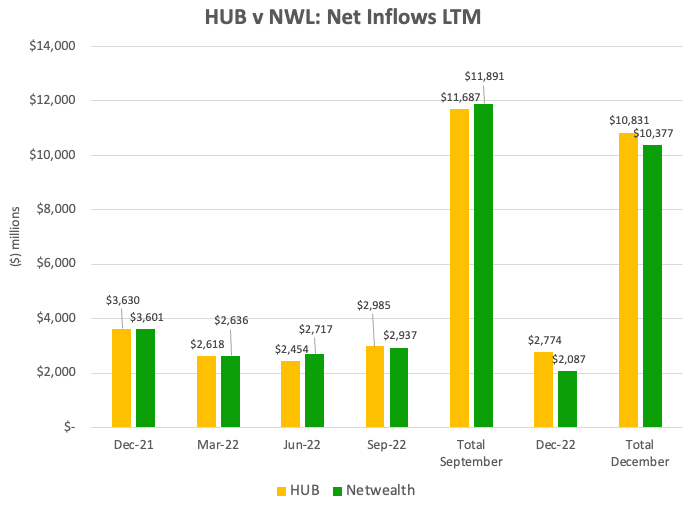

The September data (first image) from Plan for Life shows Netwealth as the leader in platform net inflows, a position it has held for several years. However, Netwealth incurred an unusual amount of outflows in the December quarter, leading to a noticeable drop in net inflows. As a result, when the December data is released, it should show HUB24 growing FUA more strongly. Quarter-to-quarter variations are common, but further outflows could signal a bigger problem.

On the investor call, Heine said the higher outflows were from high-net-wealth clients, who are on lower-fee plans. Funds were moved off the platform to invest in alternatives (private equity, unlisted assets). Additionally, funds were moved to take advantage of higher-term deposit offerings and subsequently avoid platform fees. Heine said he doesn’t expect this to be repeated. I expect this could be a broader trend, particularly regarding term deposits. There’s little incentive to sacrifice 1.35% to Netwealth when you receive a better rate at a bank.

The move to off-platform is a common problem for advisers. Not all client assets are listed, so it’s difficult to provide a full picture using a wealth platform. To counter this, Netwealth will launch a multi-asset platform service (MAPS) in March, which will cater to non-custodial assets. While this might not be a big revenue driver, it will open up Netwealth to a broader client base such as private wealth firms who use spreadsheets or in-house software.

Are Netwealth Shares Good Value?

Based on analyst estimates and a share price of $13.90, Netwealth is trading on a price-to-earnings ratio of 49. This implies several years of growth are already priced in. To find the shares attractive, investors would likely need to have confidence Netwealth will be able to maintain or grow its client inflow momentum without sacrificing profit margins.

As I covered extensively with HUB24 (ASX: HUB), the current wealth platform market has many competitors, which could lead to competition on price. I’m also reminded of a quote by Jeff Bezos: “Your margin is my opportunity”. At the current share price, management’s plan to flex operating leverage will have to work if the shares are to outperform.

To keep up to date with all our reporting covering, be sure to bookmark our ASX Small Cap Earnings Season Calendar For February 2023.

Disclosure: the author of this article does not own shares in Netwealth and the editor also does not. Neither will trade shares in Netwealth for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.