Mach7 (ASX: M7T) Misses Guidance In Q4 FY 2023 Quarterly Report

Mach7 (ASX:M7T) ARR has declined slightly and Mach7 missed its operating cash flow guidance in Q4 FY 2023. However, Q1 FY 2024 should be stronger.

Mach7 (ASX:M7T) ARR has declined slightly and Mach7 missed its operating cash flow guidance in Q4 FY 2023. However, Q1 FY 2024 should be stronger.

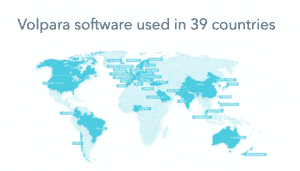

Volpara (ASX: VHT) remains close to profitability in Q1 FY 2024, showing good cost control and continuing revenue growth.

The Supply Network full year profit result will come in 3.4% above the guidance given in May 2023.

Alcidion’s cashflow is heading in the right direction but still no word on when to expect statutory profits.

Record quarterly results cause the Mader Group (ASX: MAD) share price to soar to new highs.

The Audinate share price implies solid growth for years to come, but what should we expect in FY 2023?

The 5th consecutive quarter of positive operating cash flow from Dropsuite was overshadowed by an announcement from Microsoft.

Pathology workflow software stock Beamtree (ASX: BMT) saw its share price fall from almost 20x revenue per share to around 3x.

The Cirrus Networks (ASX: CNW) share price has responded positively to an update on the Cirrus Networks profit result for FY 2023.

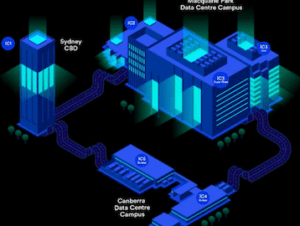

Macquarie Telecom Group (ASX: MAQ) is an attractive stock for at least three reasons, but the valuation may raise eyebrows.

Despite a stellar track record of growing earnings, cashflow, and dividends, this tailwind stock hasn’t yet joined the S&P ASX 200.

Pexa Group (ASX: PXA) owns one of the most attractive businesses on the ASX, but the Pexa share price is in a slump.

As they are trading well below their 52 week highs, each of these stocks may tempt their shareholders to sell too cheap, to minimise tax.

Why has Supply Network performed so much better than Maxiparts?

Would you sell Best And Less (ASX: BST) shares to Brett Blundy and Ray Itaoui at $1.89?

DGL Group (ASX: DGL) shares have dropped a long way from the highs, and arguably DGL Group shares are now quite cheap.

During 2022 it onboarded 89 new direct transacting partners including 7 distributors, and 819 new indirect transacting partners.

With losses, negative free cash flow, and debt, Service Stream stock combines multiple risk factors into one stinky sandwich.

Xero (ASX: XRO) shares rise after the FY 2023 Xero result demonstrates increasing focus on profitability and free cash flow.

ASX listed Insurance brokers AUB Group (ASX: AUB), Steadfast Group (ASX: SDF) and PSC Insurance (ASX: PSI) have been strong performing stocks.