Breville (ASX: BRG) Result H1 FY 2023: Inventory Balloons 58%

Will Breville clear its inventory and pay down it’s debt before sales momentum begins to wane?

Will Breville clear its inventory and pay down it’s debt before sales momentum begins to wane?

Price increases powered strong revenue growth but the H1 FY 2023 Audinate Results still had some negatives.

HUB24 is expected to become the number one wealth platform for inflows, but will this result in higher future profits?

10 quarterly snapshots: Raiz (ASX: RZI), Volpara (ASX: VHT), SciDev (ASX: SDV), NextEd (ASX: NXD), Ensurance (ASX: ENA), Playside Studios, Wisr (ASX: WZR) and more…

Dicker Data earnings per share came in at 41.5c compared to analyst consensus estimates (per CapIQ) of 43c per share.

IntelliHR has agreed to a takeover offer by Humanforce at $0.11, expected to be finalised by Mid May 2023.

Little known before January, these two small ASX stocks are in the spotlight — and on my watchlist — due to surprisingly strong quarterly reports.

Sequoia (ASX: SEQ) is profitable, cashflow positive, and increasing its dividend. But EPS will be weak in FY 2023.

Credit Clear’s December quarter receipts were roughly flat on the September Quarter, due to a pause in collections over Christmas.

A couple of late payments (now received) contributed to disappointing cashflow for Alcidion, in Q2 FY 2023.

Mach7 Technologies (ASX: M7T) reported record sales but relatively weak cash flow in Q2 FY 2023.

The Q2 FY 2023 MedAdvisor quarterly cash flow report showed record receipts and more than $21 million operating cashflow, in a quarter, from a company with a market cap of less than $165 million.

PEXA Group (ASX: PXA) is a resilient software company, dominating its niche. But is the share price justified?

Fiducian Group (ASX:FID) has more than tripled dividends over the last decade, and directors have been buying shares.

After reviewing all the small listed IT consulting companies, these 3 caught my eye as the ones that I’m most interested in.

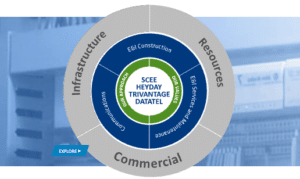

ASX Dividend Investors may wish to look at Southern Cross Electrical Engineering (ASX:SXE) with its 7.1% fully franked dividend yield.

Mach7 Technologies has announced its biggest ever contract win with Akumin, but its lack of profitability and CFO departure weigh on the mind.

This profitable ASX-listed business might not be top quality, but the next few years could see good growth.

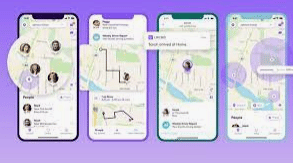

Life360 has been a popular ASX tech stock, but is the Life360 business model attractive to potential investors?

Alcidion is an unprofitable healthcare software stock, and Duratec is a low margin contractor. But both companies are winning new contracts.