10 ASX Small Cap Quarterly Updates At A Glance

10 quarterly snapshots: Raiz (ASX: RZI), Volpara (ASX: VHT), SciDev (ASX: SDV), NextEd (ASX: NXD), Ensurance (ASX: ENA), Playside Studios, Wisr (ASX: WZR) and more…

10 quarterly snapshots: Raiz (ASX: RZI), Volpara (ASX: VHT), SciDev (ASX: SDV), NextEd (ASX: NXD), Ensurance (ASX: ENA), Playside Studios, Wisr (ASX: WZR) and more…

Dicker Data earnings per share came in at 41.5c compared to analyst consensus estimates (per CapIQ) of 43c per share.

Little known before January, these two small ASX stocks are in the spotlight — and on my watchlist — due to surprisingly strong quarterly reports.

Credit Clear’s December quarter receipts were roughly flat on the September Quarter, due to a pause in collections over Christmas.

A couple of late payments (now received) contributed to disappointing cashflow for Alcidion, in Q2 FY 2023.

Mach7 Technologies (ASX: M7T) reported record sales but relatively weak cash flow in Q2 FY 2023.

The Q2 FY 2023 MedAdvisor quarterly cash flow report showed record receipts and more than $21 million operating cashflow, in a quarter, from a company with a market cap of less than $165 million.

PEXA Group (ASX: PXA) is a resilient software company, dominating its niche. But is the share price justified?

Fiducian Group (ASX:FID) has more than tripled dividends over the last decade, and directors have been buying shares.

IT consulting companies can have very cyclical earnings, but bit long term digitisation trends can drive rare success stories.

After reviewing all the small listed IT consulting companies, these 3 caught my eye as the ones that I’m most interested in.

ASX Dividend Investors may wish to look at Southern Cross Electrical Engineering (ASX:SXE) with its 7.1% fully franked dividend yield.

Mach7 Technologies has announced its biggest ever contract win with Akumin, but its lack of profitability and CFO departure weigh on the mind.

I made a very bad investing mistake in 2022. By beating myself up for it, I hope not to lose the lesson.

This profitable ASX-listed business might not be top quality, but the next few years could see good growth.

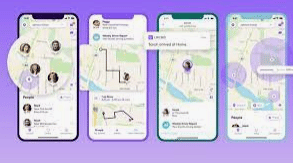

Life360 has been a popular ASX tech stock, but is the Life360 business model attractive to potential investors?

Alcidion is an unprofitable healthcare software stock, and Duratec is a low margin contractor. But both companies are winning new contracts.

IPD Group (ASX: IPG) is a recently listed electrical component distribution company that is already profitable and paying dividends.

These 5 ASX small-cap companies all disclosed continuing growth in their AGM presentations, providing a good opportunity to check in on the thesis.

The Aussie Broadband business model is superior customer service but that does not mean Aussie Broadband (ASX: ABB) is a high quality stock.