Is IPD Group (ASX: IPG) A Small Cap With Large Potential?

IPD Group (ASX: IPG) is a recently listed electrical component distribution company that is already profitable and paying dividends.

IPD Group (ASX: IPG) is a recently listed electrical component distribution company that is already profitable and paying dividends.

These 5 ASX small-cap companies all disclosed continuing growth in their AGM presentations, providing a good opportunity to check in on the thesis.

The Aussie Broadband business model is superior customer service but that does not mean Aussie Broadband (ASX: ABB) is a high quality stock.

The 2022 Pro Medicus AGM highlighted the strong competitive advantage of its key product, Visage.

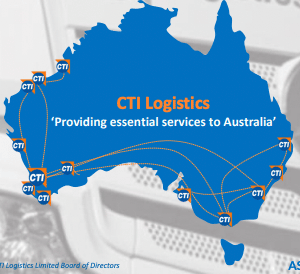

The CTI Logistics (ASX: CLX) guidance for H1 FY 2023 suggests strong revenue and profit growth in H1 FY 2023.

These three stocks have some flaws, but I can’t deny their positive features keep catching my eye.

Tuas (ASX: TUA) is an ASX listed telecom operating in Singapore. Is Tuas worth putting on your watch list?

Somebody is paying a relatively high multiple of imaginary earnings to a more knowledgeable seller (the founder and CEO of Cettire)

The H1 FY 2023 Xero results were very disappointing because the company lost money despite strong revenue growth and high gross margins.

A lucky share price spike gives me an opportunity to lock in some lucky profits and reduce my exposure to Aeris Resources (ASX: AIS).

These 5 stocks each have strong share price momentum backed up by strong recent profit growth.

Magellan Global Fund (ASX: MGF) trades at a 22.5% discount to net asset value (NAV). Is this too cheap?

It was not a good quarterly report.

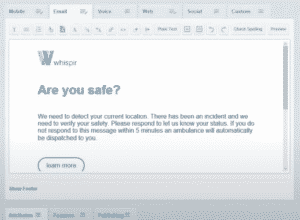

Whispir (ASX: WSP) shareholders should consider if Whispir will raise capital again. When will there be another Whispir capital raising?

The Dicker Data (ASX: DDR) Q3 FY 2022 Quarterly Update is a good time to revisit my valuation of the stock

By acquiring PaulCamper, Camplify (ASX: CHL) is building much-needed scale in the European market.

Mea culpa. I underestimated Sudan’s risk to Codan (ASX: CDA) and I’ve lost money as a result.

Aeris Resources (ASX: AIS) is a profitable copper producer based in Australia.

In FY 2022, the Altium results saw strong profit growth. But does Altium have a sustainable competitive advantage?

The Supply Network results (ASX: SNL) were great, in FY 2022, but competitor Maxiparts (ASX: MXI) is ready to pounce.