CY 2023 Investing Performance Review

The six months to June 30, 2023 were painful while the six months to December 31, 2023 were a joy.

The six months to June 30, 2023 were painful while the six months to December 31, 2023 were a joy.

Genex Power (ASX: GNX) is doing good in the world; but is it a good stock?

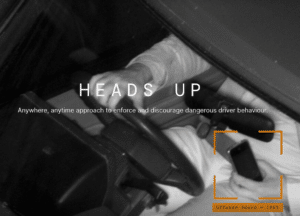

Acusensus (ASX: ACE) uses advanced technology to surveil and photograph drivers while they breaching road rules.

RAS Technology Holdings is showing stellar revenue growth; but what are the risks

Raymond Jang brings you his in-person impressions from attending the 2023 Supply Network AGM.

The share price of Xero (ASX: XRO) fell sharply after the H1 FY 2024 results; but does that make it cheap?

Vysarn’s AGM update gives us insight into to why the share price has risen, and where the company is headed.

At the FY 2023 Annual General Meeting, Altium (ASX: ALU) highlighted its focus on penetrating the enterprise market.

The FY 2023 Pro Medicus (ASX: PME) AGM further demonstrated the high quality of the business and the good nature of the leadership group.

The AGM was a good opportunity to catch up with company leadership and other shareholders.

Maxiparts (ASX: MXI) is on another acquisition hunt, vacuuming two businesses. One seems to be a great business but is it a sound investment?

Chrysos Corporation (ASX: C79) is emerging as a fast growing disruptor in a growing industry. Here’s why its watchlist worthy.

Hitech Group Australia (ASX: HIT) has achieved epic earnings growth over the past few years; and pays a decent dividend yield to boot.

3 ASX stocks are in the running to win the Australian Exporter of the Year for 2023. Are these ASX stocks on the cusp of greatness or major disappointment?

Here are some of the small-cap Annual General Meetings coming up this month.

The Nanosonics (ASX: NAN) AGM reveals challenging conditions for the hospital industry but management is buoyed by CORIS progress.

The Mader (ASX: MAD) update for Q1 FY2024 showed strong momentum however at current share price levels, is it a sound investment?

The Adore Beauty (ASX: ABY) trading update for Q1 FY2024 shows promise but is it capable of becoming more than a mediocre business in the long run?

DUG Technology (ASX: DUG) posted strong results in Q1 FY2024, but is this down to the business or external factors?

There are definitely better opportunities in small-caps after the last 18 months, but I’m still leaning cautious due to inflation.