3 ASX Retail Stocks Reveal Sales Updates In Q1 FY 2024

3 ASX retail stocks reveal falling sales in their trading updates for Q1 FY 2024 but investors should keep an eye on one retailer.

3 ASX retail stocks reveal falling sales in their trading updates for Q1 FY 2024 but investors should keep an eye on one retailer.

Playside Studios (ASX: PLY) reports record quarterly revenue with growth from the higher margin Original IP division driving the growth.

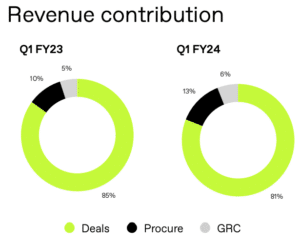

Ansarada (ASX: AND) is a genuine software business, but the challenge is that demand is potentially quite cyclical.

Spacetalk (ASX: SPA) delivered strong revenue growth in Q1 FY 2024 but investors should pay closer attention to its financial health.

RPM Global (ASX: RUL) will institute investor presentations after their results, including allowing shareholders to ask questions.

Cettire (ASX: CTT) reported rapid growth in quarterly sales in Q1 FY 2024 but questions remain over scalability.

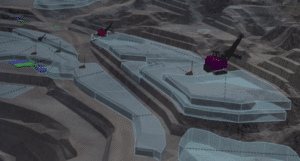

Both RPM Global (ASX: RUL) and SRG Global (ASX: SRG) are reporting strong demand from their mining clients.

Austco Healthcare (ASX: AHC) shares are up around 50% in the last 6 months. But is the investment thesis on track?

Forager (ASX: FOR) has just announced longer term plans that would allow investors to exit much closer to net asset value…

Each of these companies have interesting prospects and saw their share price spike on FY 2023 results.

Why did the Pro Medicus share price spike to a record of $78.85 this morning and what is the relevant news for Pro Medicus (ASX: PME)?

The EML Payments share price plunged in 2021 after the Central Bank of Ireland investigated it. So why is the EML share price up?

There are some tantalising aspects to the MedAdvisor (ASX: MDR) thesis, but is it a bit too risky?

The FY 2023 Laserbond results saw record earnings per share and a steady dividend, despite a lack of technology division sales.

Audinate today anounced it will raise up to $70m via a placement worth $50m and an SPP worth $20m, but the CEO sold shares 10 days ago.

The Energy One takeover offer at $5.85 may seem more attractive now that an anticipated contract has been delayed.

The mining software provider is growing its software subscription revenue and buying back shares.

The IPD Group (ASX: IPD) is up a whipping 110% in the last year, but is the easy money behind us after the FY 2023 IPD Group results?

Supply Network shares have not reacted to a strong set of FY 2023 results, probably because Supply Network profit is in line with guidance.