IntelliHR (ASX:IHR) was founded in 2013 by its CEO, Rob Bromage, and its former CTO, Jeremy Fong. Bromage had previously worked as a Human Resources (HR) consultant and found that organisations often lacked the structured data to perform analysis on. IntelliHR was developed to be a software as a service suite for securely storing, organising and analysing HR data. Its ideal customer is a medium sized business that has a payroll provider, but isn’t yet using HR software. Key competitors include the ASX listed Elmo (ASX:ELO) and Cornerstone OnDemand (Nasdaq: CSOD).

IntelliHR is designed to collect and store information about who employees are, their tenure, what teams they work on, whether they are achieving their work goals and how happy they are. You can see in the screenshot below how an IntelliHR dashboard provides a simple view into how well a company is retaining staff.

Of course, this is only the beginning, and IntelliHR allows leaders and the HR department to explore the reasons for high turnover; for example, you can assess turnover by team leader. As the saying goes, people don’t leave companies they leave managers.

I’ve seen this play out personally; a single inept, white-anting manager promoted beyond his own competence can easily drive multiple higher performing employees to quit, because inept insecure managers will try to keep more talented people down, since they feel threatened by merit based promotion. Ironically, these departures serve the inept manager, who now faces less competition, but causes the company itself to lose higher potential employees in whom they have already made significant investments. One single unbearable manager can undermine an attractive remuneration and retention package and positive workplace culture.

Speaking of culture, IntelliHR also has mechanisms to track overall company sentiment, such as by using keyword analysis on the sum total of “various surveys, pulses, diary notes, performance reports and check-ins”. You can see how that dashboard might look, below:

Overall, you can see how as an organisation grows, it eventually would benefit from some kind of HR software. At its most basic, the $6 per user per month plan allows an organisation to measure and monitor employee engagement, organisation structure, and staff sentiment, while the full suite at $16 per user per month allows automated on-boarding and departure workflows, certification compliance monitoring, turnover analysis and much more. Happily, shareholders can peruse the different features by clicking on each one on the IntelliHR order page.

Completely Sub-scale To Somewhat Sub-scale

One of the things that make IntelliHR (ASX: IHR) a little bit special is that it listed before it really had a viable business. Just 5 years after it was founded, the company listed on the ASX in 2018. In the year to 2017, it had generated just $111,000 in cash receipts, and at the time of listing it boasted just 18 contracted customers.

Since that time, it has increased its customer numbers by more 10x, and its trailing twelve months receipts from customers have increased by about 20x. As you can see below, the company hasn’t been burning too much cash. Excluding grants, it has been burning just under $2.5m per year for the last couple of years. In that time, quarterly cash receipts roughly doubled. Notably, Covid (first impacting in the March 2020 quarter) seems to have accelerated growth after an initial slowing. However, the last quarter saw burn increase to about $1.5m and I wouldn’t be surprised if spending increases further due to their stated plan of spending more on sales in the USA and UK.

Until July this year, this heartening organic growth (albeit off a small base) had gone largely unappreciated by the market. As it happens, I had a greedy limit order to buy shares in the company at slightly below the prevailing share price, when Bevan Slattery made a $2.5m investment at 7.5 cents per share. As you can imagine, I felt the fool with my greedy order at below 7c, when Bevan Slattery had spotted the opportunity to ‘pay up’ — and still get a bargain. Adding salt to my greedy wound, the company then did the right thing by all shareholders, and instituted a renounceable rights offer for all shareholders at the same price they’d sold shares to Bevan.

Notably, the company only has just over $5m in the bank. At current rates of expenditure, that will last less than a year, and it’s possible that the recent share price weakness is a symptom of the market’s expectation that the company will need to raise capital again soon. In any event, we should expect more dilution at some point.

Organic Growth Proves A Product

One of the things that really jumps out about IntelliHR is that it has grown organically. On top of that, it has managed to grow organically, internationally, and it has a presence in the UK, USA and Australia, all at the same time. Part of the secret sauce here is that they have focussed on building modules that don’t require specific capabilities for specific jurisdictions. Thus, the company has not bothered with Payroll or educational materials. Rather, it offers a platform that sits alongside an existing payroll provider. I note the IntelliHR platform integrates directly with Xero, and although I can’t confirm it, I do wonder whether Xero’s growth in those jurisdictions might ultimately benefit IntelliHR.

One thing that is interesting is that the more mature competitor Elmo HR (ASX: ELO), has been acquiring ferociously to grow. In its most recent half, Elmo grew revenue by $23.6m in the first half last year, to $30.6m in this half. However, In October 2020 it bought BreathHR, and in December 2020 it bought Webexpenses. Between them these business should add about 25% to the company’s revenue and in total, Elmo has made 9 acquisitions since listing. Now, Elmo itself is an interesting business, but it makes considerable increasing losses, and insiders have been consistently selling shares over recent years. It is also far more concentrated in Australia, and doesn’t have transparent pricing on its website. Its inability to run anywhere near breakeven suggests poor capital allocation is at play.

One concern I have is that IntelliHR follows the same path, choosing to bolt on multiple little acquisitions while increasing the amount of money it loses each year. I can tolerate increasing losses, but only if the loss is taken to grow organically. Ultimately, knitting together 9 different acquired businesses is a recipe for a weaker product, and vendors generally understand what they are selling better than buyers do, anyway. To me, an ability to grow organically is proof the company has the right team in place to continually improve the product (and sell it). If IntelliHR looks to start acquiring, I’ll likely sell my shares.

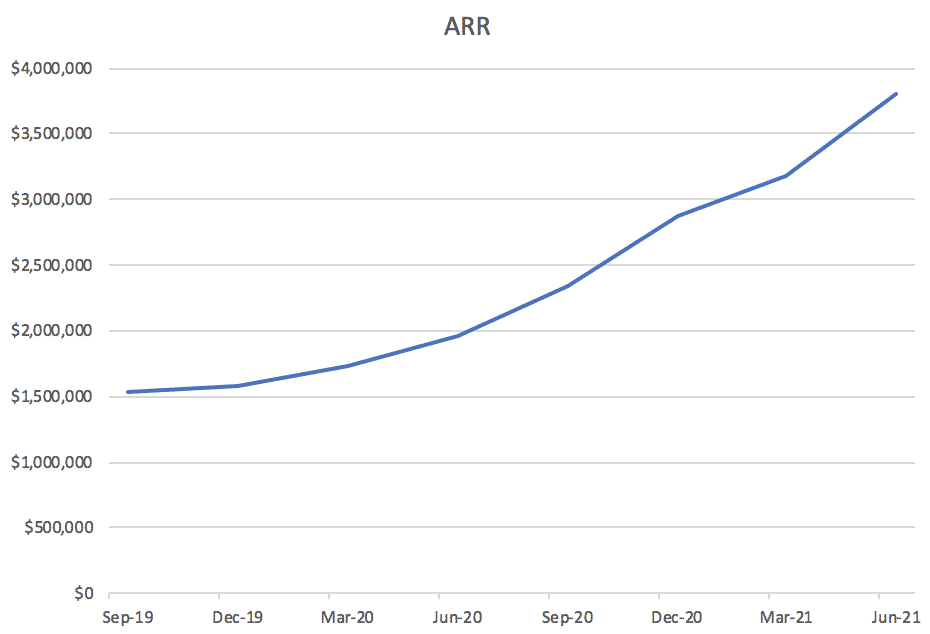

One of the reasons I have been buying IntelliHR recently is that it updated the market on its ARR to Jun-2021, implying very strong growth over the last quarter, as you can see below:

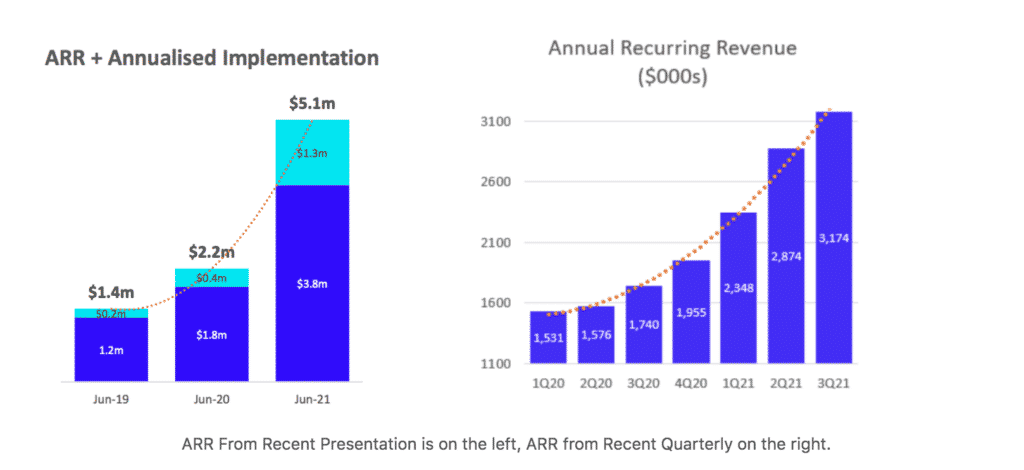

However, this also lead me to a slight discrepancy in their reporting. As you can see below, the ARR for June 2020 is either $1.8m or $1.955m, depending on whether you rely on their recent presentation or their recent quarterly.

I reached out to the CEO about this discrepancy and he promptly replied that he believes that the Jun-21 figure presented in the left chart (as well as the Jun-20 one) is the data for the 12 months to June 4. This makes sense and is actually indicated on the presentation; implying it was actually a silly question by me. Importantly, it also implies that the real ARR for June 30, 2021, may be even better than my chart above implies! Finally it also showed that the CEO is attentive and friendly and cares about retail shareholders being well informed.

At the current share price of $0.255, IntelliHR has a market cap of about $71 million. If we take the $3.8m ARR figure on its merits, then the company is trading on about 18.6x ARR which is up about 90% over the last year. Even if the company only grows to about $5m ARR over the next year, it would be trading at 14.2x revenue and growing at around 30%, which would be reasonable enough.

For those with little patience for revenue multiples, it’s worth considering that in the last half the company only lost $3m on revenue of $1.3m, so it’s likely the business could reach breakeven at around $10m in revenue (though it may have increased spending by then). For me, the big test will be whether IntelliHR can breakeven with $10m in revenue, or if expenses continue to run well ahead of revenue growth, as is the case with Elmo.

Why I Own IntelliHR

To my mind, IntelliHR is a high risk stock because it still loses money and it’s still subscale. Offsetting that risk, we see growth rates in the order of 90%, a deep-pocketed backer, a CEO with over 10% of the company and increasing evidence the company can take market share by providing a more attractive value proposition than competitors. The entire growth thesis rests on the high organic growth rates, which have been achieved without insane losses. If these conditions hold, then I’m willing to buy what are admittedly optimistically priced shares.

At half the price, I believe IntelliHR would be very good value. At todays prices, I’m buying partially out of fear that the company never gets cheap. If the share price falls while growth continues to be strong, I’d probably even buy more. Having said that, if growth rates stagnate or losses blow-out (or both), I’d probably sell my shares.

IntelliHR operates in a competitive environment, so it’s certainly not clear that this stock will be a winner. But if its growth rates are anything to go by, its product resonates in a global market, and it has built a globally competitive product from scratch. That in itself is quite rare to see.

What makes IntelliHR catch my eye right now is that all it needs to do to become a much larger company is to scale up. That will take an honest and competent leader who inspires loyalty in his team. Arguably, the move towards working from home will create a deman tailwind for the next few years, so it certainly is fortuitous that IntelliHR already has some traction. I believe management is honest and competent.

I use all sources to judge the nature of CEOs I invest with, but one quote from this interview really stood out as an example of why I believe IntelliHR has a good culture. CEO Rob Bromage said [in the context of a global pandemic] that: “protecting your people, protecting their family, is your number one priority… You’re responsible for everybody you employ and their families, their lives, their wellbeing. I want to see everybody we employ be successful in their personal lives as well.”

I think this ethos leads to a happier, more productive workplace. Ironically, it also touches on the value proposition IntelliHR provides to its customers, who are looking for a way to retain their most valuable staff. It may seem ridiculously simple but humans operate on reciprocity. Few employees will show loyalty or protectiveness towards a company that shows no loyalty or protectiveness to them, and nor should they. And yet employee loyalty is often the biggest single driver of success.

The author owns shares in IntelliHR. This post is not financial advice, and you should click here to read our detailed disclaimer.