This morning, the IntelliHR (ASX:IHR) quarterly results were released to market with the share price gaining 6% on open. Put simply, the IntelliHR Q4 FY cashflow report shows strong organic growth off a low base. I recently explained why IntelliHR catches my eye, so this short update will just focus on the latest developments. During the quarter, it received a record $1.15m and burnt through a record $1.58m. This means it is continuing to increase spending, but happily, this spending is accelerating growth. You can see what I mean in the cash flow chart below:

IntelliHR only has about $4m cash in the bank, so with current levels of expenditure it’s reasonable to expect another capital raising before too long. However, the good news from this quarter is that the increase in receipts was the highest on record relative to the cash burn, over the last six months. This is a useful metric to track because as long as it is increasing, it implies that the business has improving unit economics.

This view is supported by the fact that the company said that “the APAC region [is] already generating full payback on regional sales and marketing spend within 1 year”, and that they are working to bring customer acquisition costs in the UK and the US to those same levels.

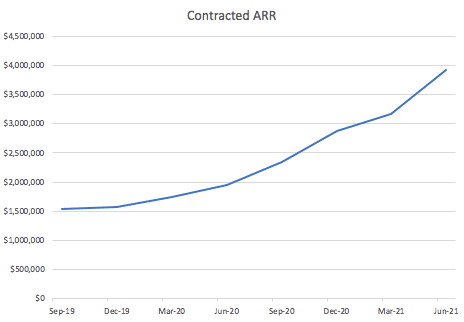

Contracted ARR was $3.92m at the end of the quarter, up from $3.8m at 4 June, implying that the company is added about $0.1m in contracted ARR over the last month. That would see contracted ARR go up to about $5.1m at the end of next year. I’m not sure their exact definition of contracted ARR but it doesn’t seem aggressive since the company reported $929,000 in subscription revenue for the quarter which would annualise to just over $3.7m. So it seems the contracted ARR may actually just be based on the last month. I’ve updated the graph below.

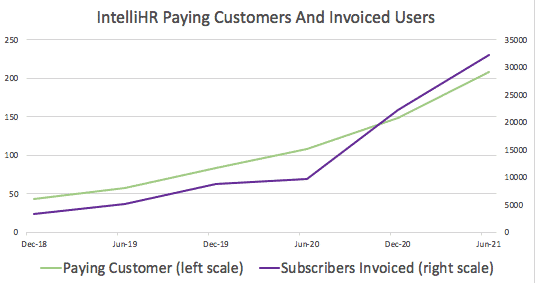

The compan’s biggest name client win this quarter was Baby Bunting, and it was good to see that were able to quote the GM of HR, Sharyn Murray, as saying “We are looking forward to partnering with IntelliHR as part of our People & Culture Transformation journey.” And as you can see below, paying customers and user numbers continue to trend in the right direction.

In conclusion, nothing about these results changes my view of the stock and they are roughly what I expected. I continue to be enthusiastic about the strong organic growth but sanguine about the increasingly evident need to raise more capital.

Please remember that these are personal reflections about a stock by author. I own shares in IntelliHR and may even trade the stock in the coming days (although I will not sell any shares for at least 2 business days after this article). This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.