This morning, workplace monitoring and safety company Damstra (ASX: DTC) finally showed some improvement in its quarterly cashflow report, reporting record quarterly revenue of $9.1 million, an increase of more than 30% on the immediately preceding quarter. This result will be a relief for shareholders, who had suffered a falling share price due to the fact that Damstra missed its guidance, blaming delayed contracts. That brings the full year revenue to $28 million, which is exactly what I have been predicting. Unfortunately, this means that the company’s guidance of “$28.5m to $30.5m in revenue” was only achieved if you include “other income”, which I do not.

The fact is that Damstra continues to trip over its own feet by providing imprecise revenue guidance, at the behest of analysts who are afraid to take a guess, and be wrong.

With this in mind, I am both delighted and baffled to see the Damstra share price up 13% at the time of writing.

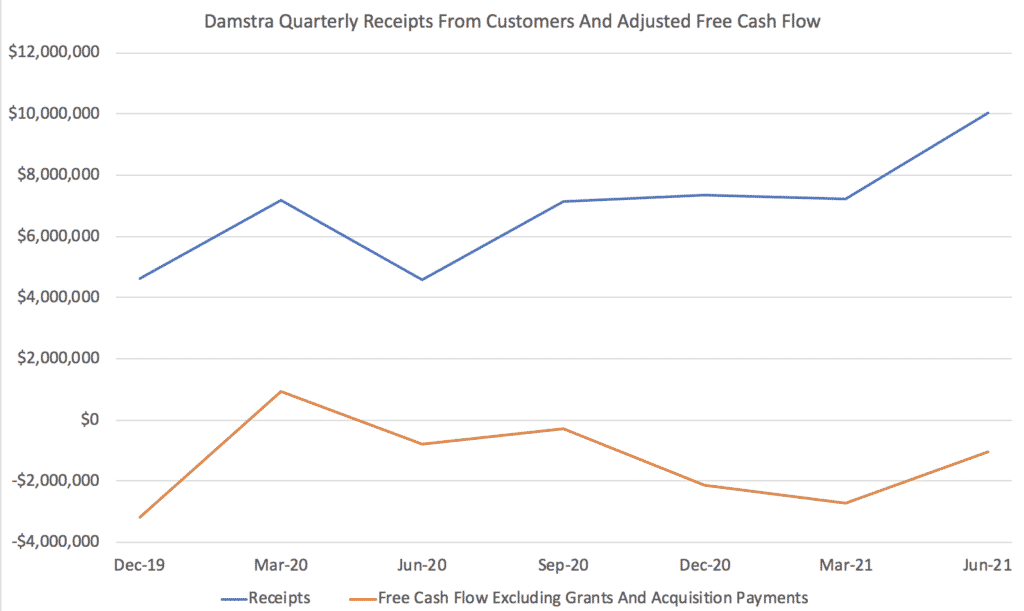

However, there was one piece of genuinely good news which was that the company noticeably reduced its cash burn, as you can see below.

Since Damstra is already taking on debt to fund operations, the most important metric for shareholder returns will be free cash flow. The biggest risk is that the management prioritise the advice of stock brokers (who profit most from indefinite capital raising) rather than shareholders (who profit most from careful use of funds, and the improved multiple that can only come in the absence of dilution.)

The biggest opportunity is if the company reaches cashflow positive, and starts paying off its debt, while still growing. That will reduce risk and enhance its reputation. With ARR of $35m, Damstra current trades at about 4.8 times recurring revenue, which isn’t bad for a business with gross margins above 75%. However, much depends on its ability to turn a profit in the next few years.

Damstra will be reporting its half year results and we will expand on our extensive coverage of Damstra at that time.

Please remember that these are personal reflections about a stock by author. I own shares in Damstra and may even trade the stock in the coming days (although I will not sell any shares for at least 2 business days after this article). This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.